Registration akc.punjab.gov.pk

The Chief Minister of Punjab, Maryam Nawaz, has familiarized the CM Punjab Asaan Karobar Loan Scheme 2025 Registration akc.punjab.gov.pk to empower folks across Punjab. This creativity aims to assist young and motivated men, women, and transgender folks in establishing or swelling their businesses through interest-free loans. The online registration process is open on the official government portals akc.punjab.gov.pk and akf.punjab.gov.pk.

To help you understand all the essential details, the following table provides a quick overview of the scheme:

| Program Name | Start Date | End Date | Amount of Assistance | Method of Application |

| Asaan Karobar Card Scheme | January 19, 2025 | February 15, 2025 | Up to PKR 10 Lakh | Online |

| Asaan Karobar Finance | January 19, 2025 | February 15, 2025 | PKR 1 Million to PKR 30 Million | Online |

What is the CM Punjab Asaan Karobar Loan Scheme 2025?

The CM Punjab Asaan Karobar Loan Scheme 2025 Registration akc.punjab.gov.pk is a fanciful program by Maryam Nawaz and the Government of Punjab to promote free enterprise and self-reliance. It is alienated into two categories:

- Asaan Karobar Card Scheme

- Designed for persons seeking small-scale loans up to PKR 10 Lakh.

- Asaan Karobar Finance Scheme

- Offers larger financial support reaching from PKR 1 Million to PKR 30 Million for traditional businesses.

This scheme is completely interest-free, making it accessible to frugally deprived groups. The program aims to uplift communities and reduce joblessness by providing easy backing chances.

Key Features of the Scheme

- Scheme Announced Date: January 19, 2025

- Total Allocation:

- PKR 48 Billion for Asaan Karobar Card Scheme

- PKR 36 Billion for Asaan Karobar Finance Scheme

- Mark-Up: 0%

- Eligibility: Males, females, and transgender persons with valid Punjab domicile

- Refund Duration:

- 3 years for Asaan Karobar Card Scheme

- 5 years for Asaan Karobar Finance Scheme

Eligibility Criteria

Eligibility for Asaan Karobar Card Scheme 2025:

- Must be a resident of Punjab.

- Applicants can be male, female, or transgender.

- Age Limit: 21-57 years.

- Must possess a valid CNIC.

- Only one person per family can apply.

- Active tax filer status is required.

- Loan can be used for new business ventures.

- Loan Amount: Up to PKR 10 Lakh.

- Installment Duration: 3 years.

Eligibility for Asaan Karobar Finance Scheme 2025:

- Must be a resident of Punjab.

- Open to males, females, and transgender persons.

- Age Limit: 25-55 years.

- Valid CNIC and active tax filer status are required.

- Applicants must live in rented accommodations.

- Must not have defaulted on any prior financial duties.

- Loan can be utilized for established businesses.

- Loan Amount: PKR 1 Million to PKR 30 Million.

- Installment Duration: 5 years.

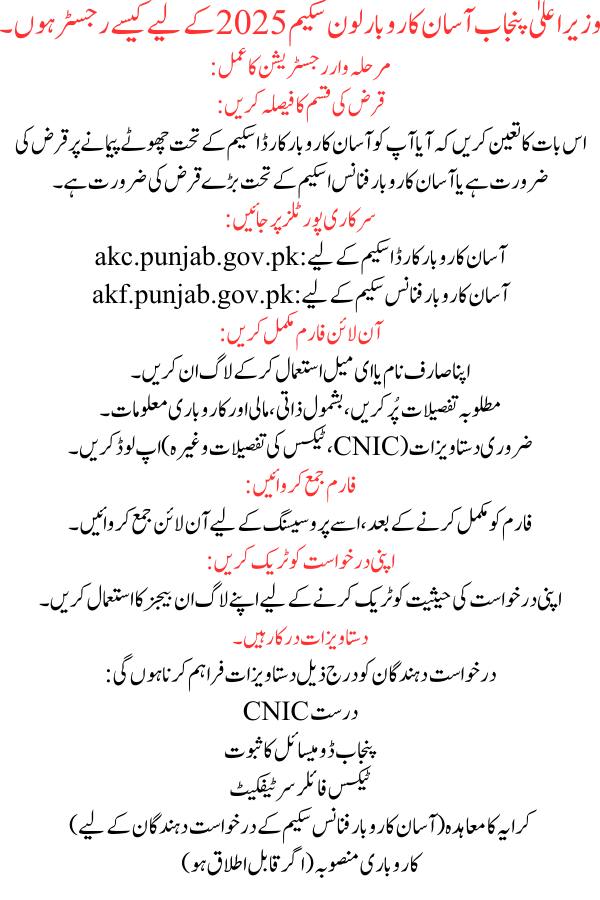

How to Register for CM Punjab Asaan Karobar Loan Scheme 2025

Step-by-Step Registration Process:

- Decide the Loan Type:

- Determine whether you need a small-scale loan under the Asaan Karobar Card Scheme or a larger loan under the Asaan Karobar Finance Scheme.

- Visit the Official Portals:

- For Asaan Karobar Card Scheme: akc.punjab.gov.pk

- For Asaan Karobar Finance Scheme: akf.punjab.gov.pk

- Complete the Online Form:

- Log in using your username or email.

- Fill in the required details, including personal, fiscal, and business info.

- Upload necessary documents (CNIC, tax details, etc.).

- Submit the Form:

- After completing the form, submit it online for processing.

- Track Your Application:

- Use your login badges to track the status of your application.

Documents Required

Applicants must deliver the following documents:

- Valid CNIC

- Proof of Punjab domicile

- Tax filer certificate

- Rent agreement (for Asaan Karobar Finance Scheme applicants)

- Business plan (if applicable)

Important Deadlines

- Registration Start Date: January 19, 2025

- Last Date to Apply: February 15, 2025

Benefits of the Scheme

- Interest-Free Loans: Ensures affordability for all applicants.

- Wide Accessibility: Open to males, females, and transgender persons.

- Large Loan Amounts: Options range from PKR 10 Lakh to PKR 30 Million.

- Empowerment: Promotes economic individuality and business growth.

- Support for New Ventures: Encourages free enterprise and invention.

FAQs

Who is eligible for the CM Punjab Asaan Karobar Loan Scheme 2025?

Residents of Punjab aged 21-57 years (Card Scheme) and 25-55 years (Finance Scheme) are eligible. Candidates must also be active tax filers and hold a valid CNIC.

Can I apply for both schemes simultaneously?

No, applicants can only apply for one scheme at a time.

How will I know if my application is approved?

Eligible applicants will be notified through SMS or email and can also check their request status on the official portals.

Is the loan refundable?

Yes, the loan must be repaid within the specified time frame (3-5 years) but without any notice.

Conclusion

The CM Punjab Asaan Karobar Loan Scheme 2025 Registration akc.punjab.gov.pk is a milestone originality that brings financial relief and commercial chances to the people of Punjab. Whether you want to start a new undertaking or expand an existing one, this scheme ensures financial obtainability and financial empowerment. Don’t miss the chance—apply now through the official gateways and take the first step toward a brighter future!

Punjab district Hafiz abad tassel pindi bhattian rustam chock

Loan application

Hi my name is Mohammed yaqoob I am leaving before and UK and Germany and cyprus so so in the Europe and now I am leaving in Pakistan I work with property and I just need loan some for my business please so you help me

So I am happy to see the Maryam Nawaz Punjab CM when she is was good worker she is the one whole she is very nice work thank you Mariam thank you Maryam Nawaz thank you

Maryam Nawaz we are very happy because you are doing like this to sleeping people who is nothing nothing to do in the life you are wake up them to make easily work and your house and you giving them money loan is very very good

Maryam Nawaz Seva aapka kam dekhkar bahut Khushi Hui hai thank u

I need some long for my business because I work with the property and I have company also thank you