Punjab Asaan Karobaar Card

The Punjab government’s major creativity, the Punjab Asaan Karobaar Card, was created to give entrepreneurs access to free of interest and simpler financial services. In order to promote financial growth at the popular level, this initiative seeks to increase the growth and viability of tiny businesses across the province.

Table of Quick Information

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Punjab Asaan Karobaar Card | 2025 | Ongoing | Up to PKR 1 million | Online |

| Punjab Business Support Card | 2025 | Ongoing | Up to PKR 500,000 | Online |

What is the Punjab Asaan Karobaar Card?

The Asaan Karobaar Card is a cutting-edge program that offers interest-free loans up to PKR 1 million to small enterprises in Punjab. To ensure organised and open fund use, the set makes use of digital stations including Point of Sale (POS) systems and mobile applications. The main goal is to give small business owners loans so they can grow and sustain their businesses.

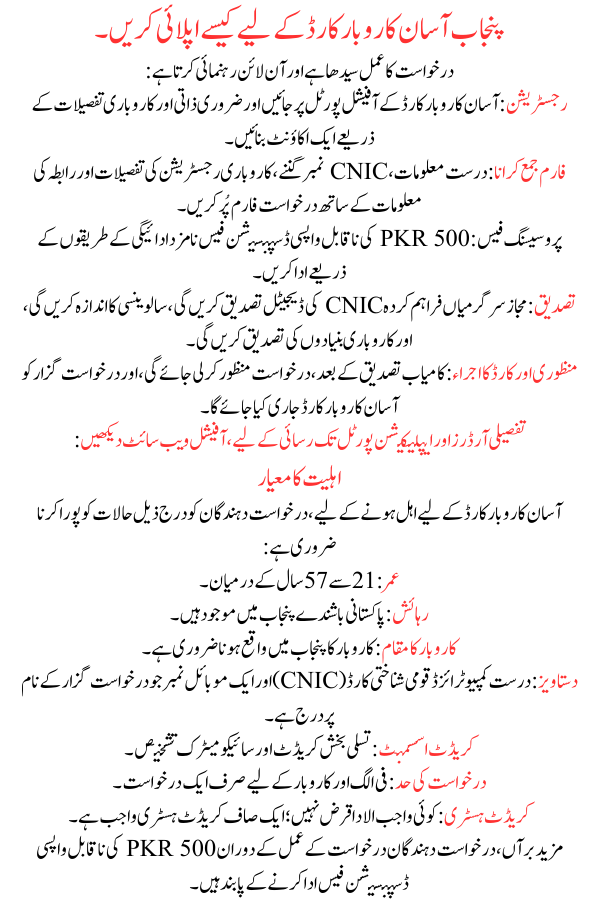

Eligibility Criteria

To qualify for the Asaan Karobaar Card, applicants must meet the following situations:

- Age: Between 21 to 57 years.

- Residency: Pakistani residents exist in in Punjab.

- Business Location: The business must be located within Punjab.

- Documentation: Valid Computerized National Identity Card (CNIC) and a mobile number recorded in the applicant’s name.

- Credit Assessment: Satisfactory credit and psychometric appraisal.

- Application Limit: Only one application per separate and business.

- Credit History: No overdue loans; a clean credit history is obligatory.

Additionally, applicants are obligatory to pay a non-refundable dispensation fee of PKR 500 during the application process.

Benefits of the Punjab Asaan Karobaar Card

The program offers several advantages to small business owners:

- Interest-Free Loans: Eligible tycoons can access loans up to PKR 1 million without any interest, easing financial loads.

- Flexible Loan Tenure: The loan tenure spans three years, with a rotating credit facility for the first 12 months.

- Grace Period: A grace period of three months is provided from the card issuance date before repayments commence.

- Digital Transactions: The card eases digital payments to vendors, suppliers, and for utility bills, taxes, and government fees.

- Cash Withdrawals: Up to 25% of the loan limit can be reserved in cash for various business needs.

How to Apply for the Punjab Asaan Karobaar Card

The application process is straightforward and led online:

- Registration: Visit the official Asaan Karobaar Card portal and create an account by if essential personal and business details.

- Form Submission: Fill out the application form with accurate information, counting CNIC number, business registration details, and contact information.

- Processing Fee: Pay the non-refundable dispensation fee of PKR 500 through the designated payment methods.

- Verification: Authorized activities will conduct digital confirmation of the provided CNIC, assess solvency, and verify business grounds.

- Approval and Card Issuance: Upon successful confirmation, the application will be approved, and the Asaan Karobaar Card will be issued to the applicant.

For detailed orders and to access the application portal, visit the official website:

Important Rules and Regulations

Applicants and cardholders must adhere to the following rules:

- Fund Utilization: The loan amount must be used strictly for business-related expenses, such as expenditures to vendors, utility bills, taxes, and official cash removals.

- Repayment Schedule: Repayments begin after a three-month grace period, with a minimum monthly payment of 5% of the unresolved loan balance.

- Registration Requirement: Businesses must register with the Punjab Revenue Expert (PRA) or the Federal Board of Revenue (FBR) within six months of card issuance.

- Non-Transferability: The card is non-transferable and future solely for the registered business owner.

- Compliance: Devotion to all terms and conditions outlined by the program is obligatory to avoid penalties or ineligibility.

Conclusion

An excellent task, the Asaan Karobaar Card aims to empower tiny tycoons in Punjab by giving them the required financial backing and resources. Business owners are able to make use of this chance to develop and maintain their creativity by being aware of the program’s qualifying demands, benefits, and application process, as well as by following its rules. This initiative contributes to the area’s overall financial development in addition to supporting growth in businesses