Maryam Nawaz New Loan Scheme

The Punjab government, under the leadership of Maryam Nawaz Sharif, has launched an interest-free loan scheme to support entrepreneurs. The initiative aims to empower small and medium-sized business owners by providing them with fiscal help to grow and succeed. This program includes two major workings: the Asaan Karobar Card Scheme for small industries and the Asaan Karobar Finance Scheme for medium-sized enterprises. Tycoons can benefit from loans ranging from PKR 100,000 to PKR 30 million. This article offers all the details you need to know about the scheme, including eligibility criteria, application methods, and benefits.

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Asaan Karobar Card Scheme | Ongoing | N/A | PKR 100,000 to PKR 1,000,000 | Online (akc.punjab.gov.pk) |

| Asaan Karobar Finance Scheme | Ongoing | N/A | PKR 1,000,000 to PKR 30,000,000 | Online (akf.punjab.gov.pk) |

Maryam Nawaz Loan Scheme

The Maryam Nawaz New Loan Scheme for Entrepreneurs is a revolutionary initiative aimed at fostering entrepreneurship in Punjab. The scheme provides interest-free loans, allowing persons to start or expand their businesses without perturbing about financial restraints. This program is exactly future to cater to the needs of small and medium-sized creativities (SMEs), making it easier for aspiring tycoons to achieve their dreams.

Key Features of the Maryam Nawaz Loan Scheme

- Ease of Registration: Simple online claim process through official websites.

- Interest-Free Loans: No interest charges, if important financial relief.

- Loan Amounts:

- Small businesses: PKR 100,000 to PKR 1,000,000.

- Medium businesses: PKR 1,000,000 to PKR 30,000,000.

- Flexible Terms: Loans have a repayment period of up to three years.

- Transparency: A straightforward process ensures clarity and fairness.

Loan Categories Under the Scheme

1. Asaan Karobar Card Scheme

- Loan Amount: PKR 100,000 to PKR 1,000,000.

- Target Audience: Entrepreneurs running or planning to start small businesses.

- Registration Portal: punjab.gov.pk.

- Registration Fee: PKR 500 (non-refundable).

2. Asaan Karobar Finance Scheme

- Loan Amount: PKR 1,000,000 to PKR 30,000,000.

- Target Audience: Entrepreneurs managing medium-sized businesses.

- Registration Portal: punjab.gov.pk.

- Registration Fee: PKR 5,000 to PKR 10,000 (non-refundable, based on loan size).

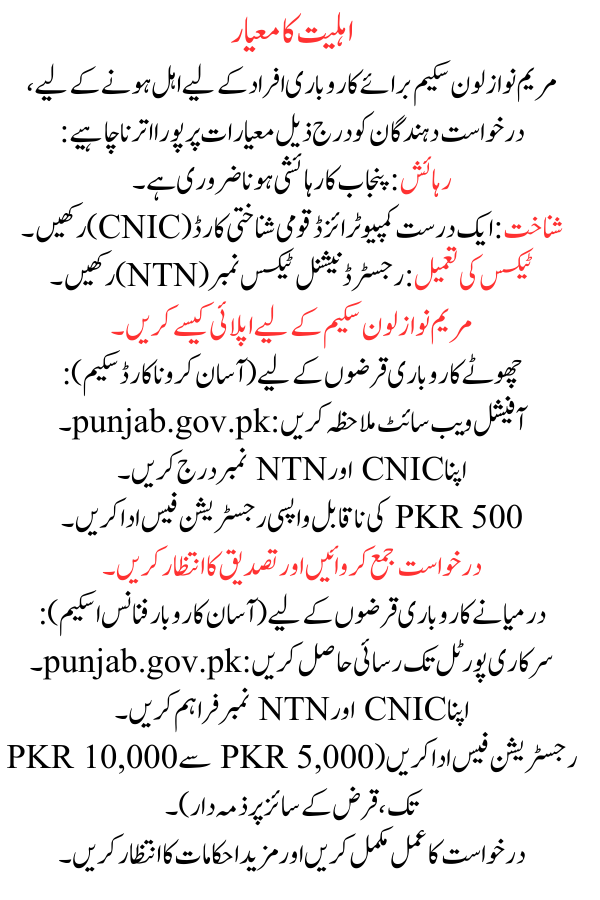

Eligibility Criteria

To qualify for the Maryam Nawaz New Loan Scheme for Entrepreneurs, applicants must meet the following criteria:

- Residence: Must be a resident of Punjab.

- Identity: Possess a valid Computerized National Identity Card (CNIC).

- Tax Compliance: Have a registered National Tax Number (NTN).

How to Apply for the Maryam Nawaz Loan Scheme

For Small Business Loans (Asaan Karobar Card Scheme):

- Visit the official website: punjab.gov.pk .

- Enter your CNIC and NTN number.

- Pay the non-refundable registration fee of PKR 500.

- Submit the application and wait for confirmation.

For Medium Business Loans (Asaan Karobar Finance Scheme):

- Access the official portal: punjab.gov.pk.

- Provide your CNIC and NTN number.

- Pay the registration fee (ranging from PKR 5,000 to PKR 10,000, liable on the loan size).

- Complete the application process and await further orders.

Benefits of the Maryam Nawaz Loan Scheme

- Empowerment: Ropes aspiring tycoons to kickstart their ventures.

- Economic Growth: Donates to job creation and enhances financial stability in Punjab.

- Financial Inclusion: Bonds the gap for underserved groups, if equal opportunities for success.

- Zero Interest: Eliminates the burden of high-interest rates, enabling better monetary planning.

Important Points to Remember

- Ensure precision in your application to avoid delays or rejection.

- The registration fee is non-refundable.

- Applications can only be submitted via official portals.

- Double-check all required documents before plan.

Frequently Asked Questions (FAQs)

What is the Maryam Nawaz Loan Scheme?

The Maryam Nawaz New Loan Scheme is a government creativity if interest-free loans to entrepreneurs in Punjab.

Who can apply for the scheme?

Any resident of Punjab with a valid CNIC and NTN number can apply for the scheme.

What is the maximum loan amount?

The scheme offers loans of up to PKR 1,000,000 for small trades and up to PKR 30,000,000 for medium-sized trades.

Are the loans interest-free?

Yes, all loans under the scheme are totally interest-free.

How do I register?

Register online through the official portals:

- For small business loans: punjab.gov.pk.

- For medium business loans: punjab.gov.pk.

Conclusion

The Maryam Nawaz New Loan Scheme is a golden chance for tycoons in Punjab to attain financial freedom and contribute to monetary growth. With interest-free loans, a clear process, and easy access, the program aims to uplift small and medium-sized trades. If you’re ready to start or enlarge your business, visit the official entries today and smear to take the first step to a wealthy future.