Maryam Nawaz Asaan Karobar Finance Scheme

Punjab Chief Minister Maryam Nawaz Sharif has presented the Maryam Nawaz Asaan Karobar Finance Scheme, aiming to deliver interest-free loans to small and medium enterprises (SMEs) in Punjab. This initiative seeks to bolster economic growth by approving businesspersons to start or expand their businesses. In this comprehensive guide, we will cover the eligibility criteria, loan details, repayment terms, equity aids, and the step-by-step registration process to help you navigate the scheme well.

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Maryam Nawaz Asaan Karobar Finance Scheme | January 16, 2025 | Ongoing | Rs 1 million to Rs 30 million | Online |

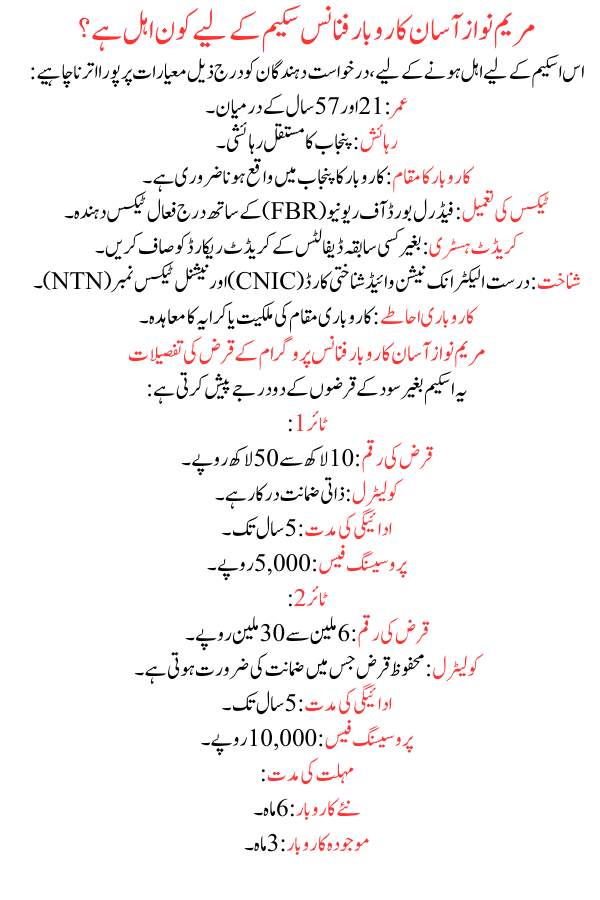

Who is Eligible for the Maryam Nawaz Asaan Karobar Finance Scheme

To qualify for this scheme, applicants must meet the following criteria:

- Age: Between 21 and 57 years.

- Residency: Permanent resident of Punjab.

- Business Location: Business must be located within Punjab.

- Tax Compliance: Active taxpayer listed with the Federal Board of Revenue (FBR).

- Credit History: Clean credit record with no previous defaults.

- Identification: Valid Electronic Nationwide Identity Card (CNIC) and National Tax Number (NTN).

- Business Premises: Ownership or rental agreement of the business location.

Maryam Nawaz Asaan Karobar Finance Program Loan Details

The scheme offers two tiers of interest-free loans:

Tier 1:

- Loan Amount: Rs 1 million to Rs 5 million.

- Collateral: Personal guarantee required.

- Repayment Period: Up to 5 years.

- Processing Fee: Rs 5,000.

Tier 2:

- Loan Amount: Rs 6 million to Rs 30 million.

- Collateral: Secured loan requiring collateral.

- Repayment Period: Up to 5 years.

- Processing Fee: Rs 10,000.

Grace Period:

- New Businesses: 6 months.

- Existing Businesses: 3 months.

Loan Repayment Terms of Maryam Nawaz Asaan Karobar Finance Scheme

Repayments are structured as equal monthly payments. A late fee of Rs 1 per Rs 1,000 per day is applicable for overdue expenses.

Equity Contribution Details of Maryam Nawaz Asaan Karobar Finance Program

- Tier 1: No equity contribution required, except for leased commercial cars, which require a 25% contribution.

- Tier 2: A 20% equity influence is standard. However, for women, transgender individuals, and persons with incapacities, the input is reduced to 10%.

Easy Registration Process of Maryam Nawaz Asaan Karobar Finance Program

Follow these steps to apply for the loan:

- Account Creation:

- Visit the official website: akc.punjab.gov.pk/cmpunjabfinance.

- Register using your CNIC-linked mobile number.

- Personal Information:

- Provide your name, father’s name, CNIC details, current address, and NTN.

- Loan Details:

- Specify business founding date, nature of business, wanted loan amount, and tenure.

- Business Details:

- Enter business name, contact info, address, monthly sales, number of staffs, and registering details.

- Financial Details:

- Provide info on business expenses, assets, obligations, and any current loans.

- References:

- Submit details of two non-family references, with their names, contact numbers, CNIC numbers, and association to you.

- Document Upload:

- Upload scanned copies of required leaflets, such as CNIC, passport-size photographs, business registration certificates, tax returns, and bank statements.

- Application Submission:

- Review all entered information and submit your application.

Upon submission, you will receive a registration number and SMS informs about your application’s status.

Frequently Asked Questions (FAQs)

What is the Maryam Nawaz Asaan Karobar Finance Program?

It is an interest-free loan program designed to support SMEs in Punjab by if financial help for business start and growth.

Who is eligible for the loan?

Applicants aged 21 to 57, who are active taxpayers, residents of Punjab, and have a clean credit history.

What are the loan categories?

Tier 1: Loans from Rs 1 million to Rs 5 million.

Tier 2: Loans from Rs 6 million to Rs 30 million.

Is there any interest on the loan?

No, the loans are entirely interest-free.

What are the processing fees?

Tier 1: Rs 5,000.

Tier 2: Rs 10,000.

What is the grace period for repayment?

New businesses: 6 months.