CM Punjab Asaan Karobar Card – A Golden Opportunity for Entrepreneurs

The CM Punjab Asaan Karobar Card is a flagship initiative by the Punjab government designed to empower small business owners. This program provides interest-free loans of up to PKR 1 million, ensuring smooth business growth and fostering economic stability. It aims to address financial challenges and promote entrepreneurship, reducing unemployment across the province.

Key Features of the Asaan Karobar Card

This scheme includes numerous features to support entrepreneurs:

- Loan Amount: Up to PKR 1 million

- Loan Tenure: 3 years

- Revolving Credit Facility: Available for 12 months

- Repayment Term: 24 monthly installments, starting after a one-year grace period

- Grace Period: 3 months post card issuance

- Interest Rate: 0% (completely interest-free)

Also Read: Asaan Karobar Scheme Register

Eligibility Criteria for the Asaan Karobar Card

Applicants must meet the following requirements:

- Residency: Punjab residents who are Pakistani nationals.

- Age: Between 21 and 57 years.

- Identification: A valid CNIC and a registered mobile number are required.

- Business Location: The business must be located in Punjab.

- Credit History: Applicants must have no overdue loans.

- Assessment: Satisfactory credit and psychometric evaluations.

- Application Limit: One application per individual or business.

Also Read: Maryam Nawaz New Loan Scheme

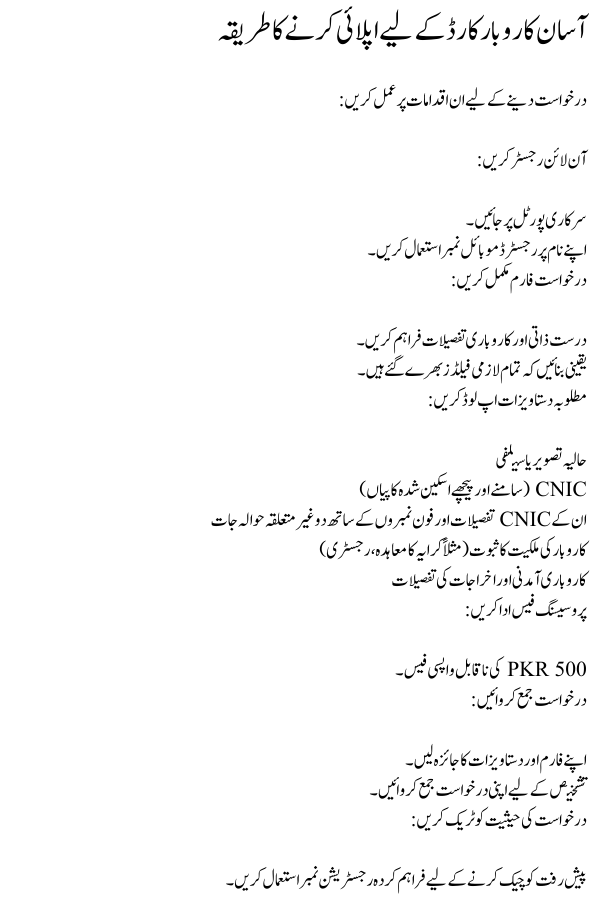

How to Apply for the Asaan Karobar Card

Follow these steps to apply:

- Register Online:

- Visit the official portal.

- Use a mobile number registered in your name.

- Complete the Application Form:

- Provide accurate personal and business details.

- Ensure all mandatory fields are filled.

- Upload Required Documents:

- Recent photograph or selfie

- CNIC (front and back scanned copies)

- Two non-relative references with their CNIC details and phone numbers

- Proof of business ownership (e.g., rent agreement, registry)

- Business income and expense details

- Pay Processing Fee:

- A non-refundable fee of PKR 500.

- Submit the Application:

- Review your form and documents.

- Submit your application for evaluation.

- Track Application Status:

- Use the provided registration number to check progress.

Also Read: PK Login for Asaan Karobar Card

Loan Utilization and Repayment Guidelines

Loan funds are allocated and utilized as follows:

- Initial 50%: Accessible within the first six months.

- Grace Period: Three months to begin usage.

- Repayment:

- Starts post grace period.

- Monthly minimum payment of 5% of outstanding balance.

- Remaining 50%: Released upon compliance with repayment and PRA/FBR registration.

Also Read: Punjab Asaan Karobar Loan Scheme

Fees and Additional Charges

Below are the applicable charges:

- Annual Card Fee: PKR 25,000 + FED (deducted from loan limit)

- Other Fees: Includes life insurance and card delivery charges.

- Late Payment Penalties: As per banking policy and schedule of charges.

Also Read: CM Punjab Karobar Card Loan Scheme Launched for Small Businesses

Documents Required

Ensure the following documents are ready:

- Passport-size photograph or selfie.

- Scanned CNIC copies (front and back).

- Registered mobile number.

- Two references (non-relatives).

- Proof of business premises.

- Income and expense documentation.

Also Read: CM Maryam Announces Punjab Asaan Karobar Scheme

Conclusion

The CM Punjab Asaan Karobar Card offers a lifeline to small entrepreneurs, removing financial barriers through interest-free loans. With its seamless application process and flexible repayment options, the scheme supports growth and self-reliance. Eligible individuals should seize this chance to achieve financial independence and contribute to Punjab’s economic prosperity.

FAQs

- Who is eligible for the Asaan Karobar Card? Entrepreneurs aged 21-57 years residing in Punjab with a valid CNIC are eligible.

- What is the maximum loan amount? Loans up to PKR 1 million are available.

- Is the loan truly interest-free? Yes, it’s entirely interest-free.

- Can the funds be used for personal expenses? No, funds must strictly serve business purposes.

- How do I apply for the loan? Register online, complete the form, and upload required documents.

- What is the repayment timeline? The repayment spans 24 monthly installments, starting after a 3-month grace period.