CM Punjab Loan Scheme 2025

Launched under the direction of the Punjab Chief Minister, the CM Punjab Loan Scheme 2025 is an innovative scheme aimed to assist startups, young entrepreneurs, and small business owners in Punjab. The Aasaan Karobaar Card Scheme and the Aasaan Karobaar Finance Scheme are the two main initiatives which make up this scheme. The program is expected to boost economic growth, create jobs, and foster entrepreneurship with a substantial budget allocation of 84 billion rupees, such as 48 billion rupees for the Aasaan Karobaar Card..

Quick Information Table

| Feature | Details |

| Name of Program | CM Punjab Loan Scheme 2025 |

| Start Date | January 2025 |

| End Date | December 2025 |

| Amount of Assistance | 1 million to 30 million rupees |

| Application Method | Online |

| Official Websites | akf.punjab.gov.pk, akc.punjab.gov.pk |

Aasaan Karobaar Finance Scheme

The Aasaan Karobaar Finance Scheme is tailored to meet the monetary needs of trades that require considerable funding for growth and growth. Here are the key highlights:

- Loan Amount: 1 million to 30 million rupees.

- Interest Rate: Completely interest-free.

- Repayment Period: Flexible repayment tenure ranging from 3 to 5 years.

- Purpose: The loans can be used for commercial growth, purchase of equipment, and other business-related needs.

- Target Audience: Established businesses and startups operating in Punjab.

This initiative aims to provide a significant financial boost to medium-sized businesses, causal to the overall economic growth of the province.

Aasaan Karobaar Card Scheme

The Aasaan Karobaar Card Scheme is precisely designed for small commercial owners and startups, offering a more nearby loan option:

- Loan Amount: Up to 1 million rupees.

- Usage: Payments for raw materials, utility bills, taxes, and rule fees. Borrowers can also withdraw up to 25% of the loan amount in cash for miscellaneous expenses.

- Repayment Period: A flexible three-year repayment plan.

- Card Features: This card operates like a business credit card, making it easier to track and manage expenses.

The Aasaan Karobaar Card Scheme is an excellent chance for small trades to steady their cash and invest in growth.

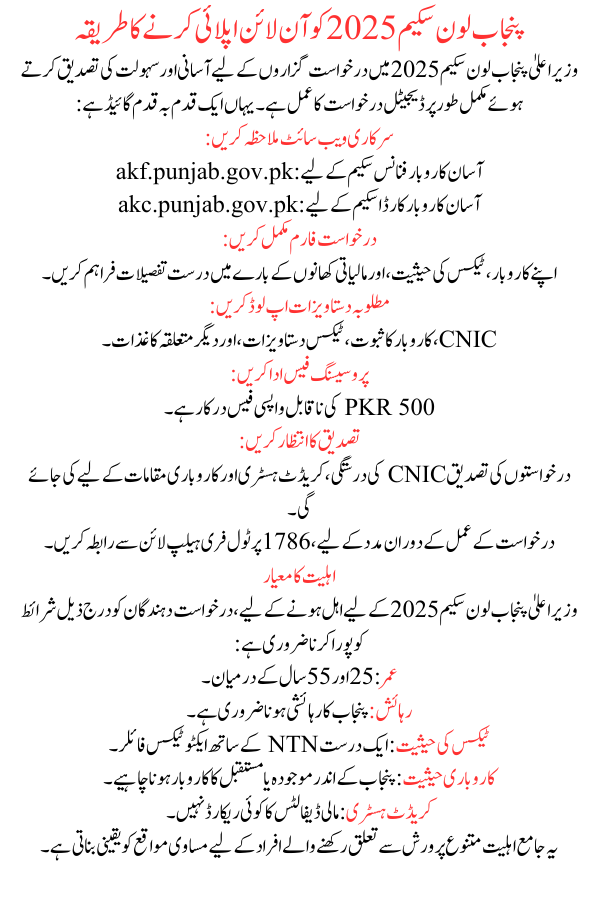

How to Online Apply Punjab Loan Scheme 2025

The CM Punjab Loan Scheme 2025 has a fully digital application process, confirming ease and convenience for applicants. Here’s a step-by-step guide:

- Visit the Official Website:

- For Aasaan Karobaar Finance Scheme: akf.punjab.gov.pk

- For Aasaan Karobaar Card Scheme: akc.punjab.gov.pk

- Complete the Application Form:

- Provide accurate details about your business, tax status, and financial foods.

- Upload Required Documents:

- CNIC, proof of business, tax documents, and other pertinent papers.

- Pay the Processing Fee:

- A non-refundable fee of PKR 500 is required.

- Await Verification:

- Applications will be verified for CNIC validity, credit history, and business locations.

For assistance during the request process, contact the toll-free helpline at 1786.

Eligibility Criteria

To qualify for the CM Punjab Loan Scheme 2025, applicants must meet the following conditions:

- Age: Between 25 and 55 years old.

- Residency: Must be a resident of Punjab.

- Tax Status: Active tax filer with a valid NTN.

- Business Status: Must have an existing or future business located within Punjab.

- Credit History: No record of financial defaults.

This comprehensive eligibility ensures equal chances for individuals from diverse upbringings.

Latest Updates on the Scheme

- Budget Allocation: 48 billion rupees have been billed for the Aasaan Karobaar Card Scheme.

- Digital Application Process: Fully online, making it user-friendly and transparent.

- Loan Disbursement: Loans of up to 30 million rupees are being disbursed under the Aasaan Karobaar Finance Scheme.

- Support Services: A toll-free helpline (1786) has been triggered to address public inquiries.

Benefits of the Scheme

The CM Punjab Loan Scheme 2025 provides numerous benefits:

- Economic Empowerment: Encourages free enterprise and job creation.

- Interest-Free Loans: Eliminates financial burdens with zero interest rates.

- Ease of Access: Online application simplifies the process.

- Support for Small Businesses: Ensures financial stability for startups and small initiatives.

- Inclusive Growth: Caters to men, women, transgender individuals, and persons with frailties.

These benefits are pivotal in driving maintainable economic growth across Punjab.

Conclusion

The CM Punjab Loan Scheme 2025 is a fanciful driver aimed at fostering free enterprise, reducing idleness, and boosting the domain’s economy. By offering interest-free loans through the Aasaan Karobaar Finance Scheme and the Aasaan Karobaar Card Scheme, the government has ensured that financial help is accessible to all eligible persons. Entrepreneurs and small business owners are fortified to take benefit of this initiative and donate to Punjab’s development.

FAQs

What is the maximum loan amount under the CM Punjab Loan Scheme 2025?

The maximum loan amount is 30 million rupees under the Aasaan Karobaar Finance Scheme.

How can I apply for the Aasaan Karobaar Card Scheme?

You can apply online at akc.punjab.gov.pk by filling out the application form and acquiescing the necessary documents.

Is there a helpline for assistance?

Yes, applicants can contact the toll-free helpline at 1786 for guidance.

Can the loan be used for personal expenses?

No, the loans are strictly for corporate purposes, such as acquiring raw supplies and paying utility bills or direction fees.

More Read