Business Loan Scheme 2025

The Punjab government, under the leadership of Chief Minister Maryam Nawaz Sharif, has introduced the Maryam Nawaz Business Loan Scheme 2025 to support entrepreneurs and small business owners. This initiative offers interest-free loans of up to Rs 30 million, enabling business owners in Punjab to expand and strengthen their enterprises.

This guide provides detailed information on loan amounts, eligibility criteria, the registration process, and necessary documents required to apply for the scheme.

Types of Loans Under Maryam Nawaz Business Loan Scheme

The Punjab government has introduced two types of business loans under this scheme:

- Asaan Karobar Card Loan – Loan of up to Rs 1 million

- Asaan Karobar Finance Scheme – Loan of up to Rs 30 million

These loans are completely interest-free, ensuring that applicants do not bear any interest burden.

Eligibility Criteria for Maryam Nawaz Loan Scheme 2025

The conditions that follow must be met if one is to apply for the Maryam Nawaz Business Loan Scheme:

• Must possess a current Pakistani National Identity Card (CNIC) or be a permanent resident of Punjab.

• The business must be owned or legally rented; • taxpayers must be registered with the Federal Board of Revenue (FBR); • No prior government or private business loans may be taken out.

For an application to be acknowledged, a few criteria must be met.

Loan Amounts and Categories

The Maryam Nawaz Business Loan Scheme 2025 offers different loan amounts contingent on the backing category:

- Asaan Karobar Card Loan – Maximum loan of Rs 1 million

- Asaan Karobar Finance Scheme:

- Tier 1 Loan – Up to Rs 5 million

- Tier 2 Loan – Up to Rs 30 million

These loans aim to support small, medium, and large-scale businesses across Punjab.

Grace Period for Loan Repayment

The scheme provides a grace period, allowing businesses time to calm before payment begins:

- Asaan Karobar Card Loan – 3 months grace period

- Asaan Karobar Finance Scheme (Tier 1 & Tier 2) – 6 months grace period

- For Business Expansion Loans – 3 months grace period

This grace retro helps ensure that trades do not face instant fiscal weight.

Processing Fee for Maryam Nawaz Loan Scheme

Applicants must pay a minor dispensation fee based on the loan type:

- Asaan Karobar Card Loan – Rs 500

- Asaan Karobar Finance Scheme (Tier 1) – Rs 5,000

- Asaan Karobar Finance Scheme (Tier 2) – Rs 10,000

These fees help filter out serious applicants for the scheme.

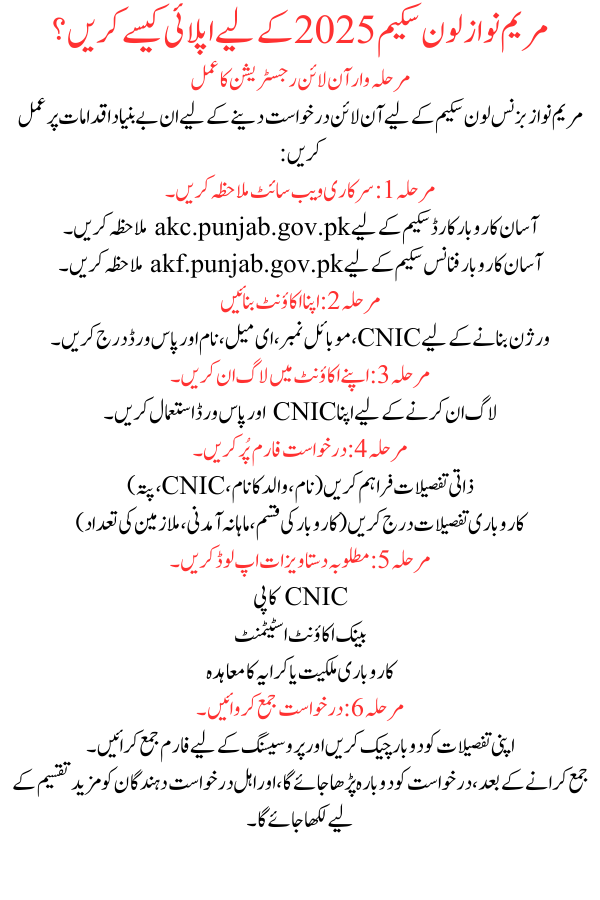

How to Apply for Maryam Nawaz Loan Scheme 2025?

Step-by-Step Online Registration Process

Follow these guileless steps to apply online for the Maryam Nawaz Business Loan Program :

STEP 1: Visit the Official Website

- For Asaan Karobar Card Scheme, visit akc.punjab.gov.pk

- For Asaan Karobar Finance Scheme, visit akf.punjab.gov.pk

STEP 2: Create Your Account

- Enter CNIC, Mobile Number, Email, Name, and Password to create an version.

STEP 3: Log In to Your Account

- Use your CNIC and Password to log in.

STEP 4: Fill Out the Application Form

- Provide personal details (Name, Father’s Name, CNIC, Address)

- Enter business details (Type of Business, Monthly Income, Number of Employees)

STEP 5: Upload Required Documents

- CNIC Copy

- Bank Account Statement

- Business Ownership or Rent Agreement

STEP 6: Submit the Application

- Double-check your details and submit the form for processing.

Once submitted, the application will be reread, and eligible applicants will be wrote for further dispensation.

Final Words on Maryam Nawaz Business Loan Scheme 2025

The Maryam Nawaz Business Loan Program 2025 is a golden opportunity for small and large business holders in Punjab to expand and soothe their trades without financial burden. Since the loans are interest-free, they provide a important gain for those observing to start new businesses or grow existing ones.

If you meet the eligibility criteria, don’t miss this chance to apply and take your commercial to new heights with government provision.

Frequently Asked Questions (FAQs)

Is the Maryam Nawaz Loan Program available in all provinces?

No, this scheme is exactly for residents of Punjab.

Can I apply if I already have a business loan from a private bank?

No, candidates must not have taken a loan from any private or direction institute before applying.

How long does it take to process my application?

Request dispensation may take a few weeks, depending on confirmation and support procedures.

Is there any collateral required for the loan?

No, this is an interest-free loan with no collateral vital.

What happens if I fail to repay the loan?

Miscarriage to repay the loan may result in lawful action and banning from future rule systems.