Business Finance Scheme For Entrepreneurs

The Government of Punjab has introduced a substantial initiative to bolster free enterprise and rouse economic growth within the province. With a total allocation of Rs 132 billion, this program covers two key schemes: the Punjab Easy Business Finance Scheme and the Punjab Asaan Karobaar Card Scheme. These wits are designed to provide interest-free loans and efficient financial access to entrepreneurs, thereby growth business growth and job creation across Punjab.

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Punjab Easy Business Finance Scheme | Jan 21, 2025 | Ongoing | Up to Rs 1 million | Online |

| Punjab Asaan Karobaar Card Scheme | Jan 21, 2025 | Ongoing | Up to Rs 1 million | Online |

Punjab Easy Business Finance Scheme

Launched on January 21, 2025, the Punjab Easy Business Finance Scheme For Entrepreneurs is the province’s largest business finance initiative, with an allocation exceeding Rs 84 billion. The scheme aims to provide over Rs 36 billion in interest-free loans to eligible beneficiaries. Each applicant can receive a loan of up to Rs 1 million, repayable in easy monthly installments over a period of five years. This creativity is inclusive, targeting men, women, transgender individuals, and persons with incapacities aged between 25 and 55 years, residing in Punjab. Applicants must be active tax filers and free from any financial defaults. Applications can be submitted online finished the dedicated portal:

Punjab Asaan Karobaar Card Scheme

Completing the finance scheme, the Punjab Asaan Karobaar Card Scheme has been allocated Rs 48 billion to support startups and small businesses. This scheme offers interest-free loans of up to Rs 1 million, repayable over three years. The Asaan Karobaar Card and Business Finance Scheme For Entrepreneurs eases payments to vendors for raw materials, government fees, taxes, and utility bills. Additionally, cardholders can withdraw up to 25% of the loan amount in cash for miscellaneous business expenses. Eligibility criteria mirror those of the finance scheme, and applications are processed online via akc.punjab.gov.pk.

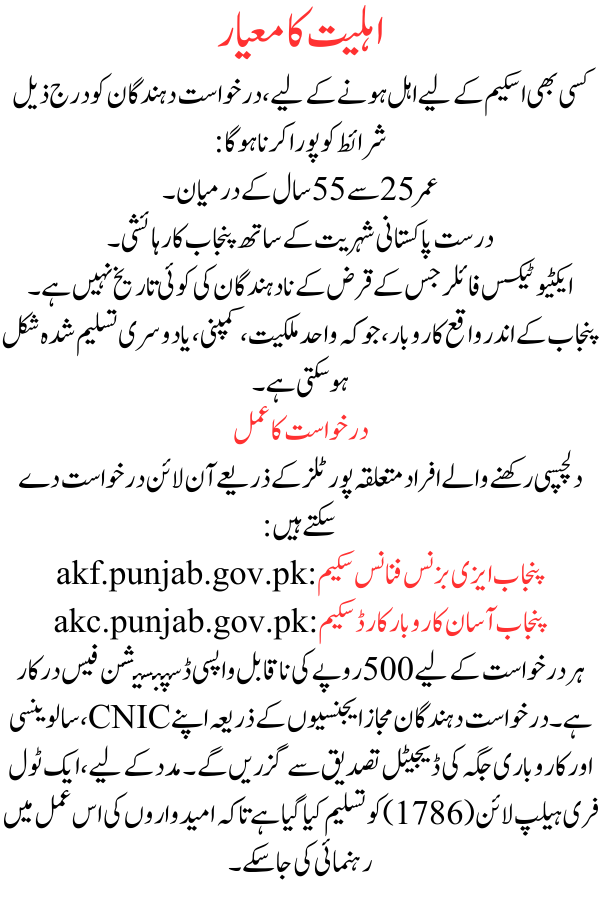

Eligibility Criteria

To qualify for either scheme, applicants must meet the following conditions:

- Age between 25 and 55 years.

- Resident of Punjab with valid Pakistani nationality.

- Active tax filer with no history of loan defaults.

- Business located within Punjab, which can be a sole proprietorship, company, or other recognized form.

Application Process

Interested individuals can apply online through the respective portals:

- Punjab Easy Business Finance Scheme: akf.punjab.gov.pk

- Punjab Asaan Karobaar Card Scheme: akc.punjab.gov.pk

A non-refundable dispensation fee of Rs 500 is required for each request. Applicants will undergo digital verification of their CNIC, solvency, and business premises by authorized agencies. For help, a toll-free helpline (1786) has been recognized to guide candidates through the process.

Benefits of the Schemes

These initiatives are designed to promote self-employment and support small enterprises in Punjab. By if financial assistance, the government aims to authorize tycoons to expand their businesses, thereby contributing to economic growth and increased exports. The complete nature of the schemes ensures that diverse sections of the populace, including women and sidelined groups, have access to the resources needed to prosper in the business landscape.

Conclusion

The Punjab Easy Business Finance Schemes For Entrepreneurs mean a important pledge by the Government of Punjab to foster free enterprise and economic development. By offering large financial support and efficient application processes, these programs aim to empower persons to found and grow their businesses, leading to job formation and a more robust cheap in the area.