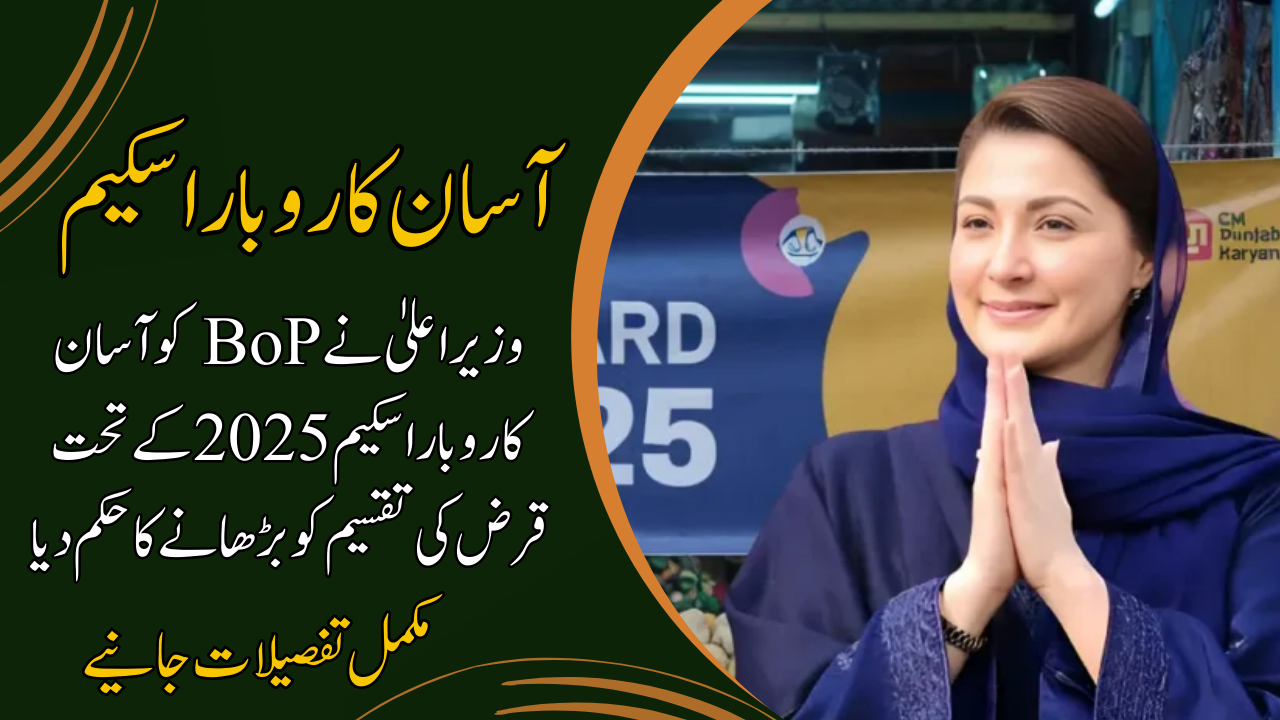

Asaan Karobar Scheme 2025

Chief Minister Maryam Nawaz Sharif has asked the Bank of Punjab (BoP) to keep up and increase loan distributions under the ‘Asaan Karobar’ Scheme, a significant step towards encouraging free enterprise and helping small enterprises in Punjab. The purpose of this directive is to ease economic growth and job creation by giving monetary support to medium-sized enterprises (SMEs) and rising tycoons across the province.

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Asaan Karobar Scheme 2025 | January 16, 2025 | Ongoing | Rs. 10 lakh to Rs. 3 crore | Online |

What is the ‘Asaan Karobar’ Scheme?

SMEs and aspiring tycoons may get interest-free financial support under the Punjab government’s innovative ‘Asaan Karobar’ Scheme. The program, which launched on January 16, 2025, provides loans between Rs. 10 lakh and Rs. 3 crore with the goal of making it easier for local firms to start and grow. The main goal is to remove monetary barriers so that people can follow their business goals free from the weight of interest payments.

Features of the ‘Asaan Karobar’ Scheme

The scheme is organized to offer maximum support with minimal difficulty. Key features include:

- Interest-Free Loans: Recipients can access loans without any interest charges, reducing the financial strain associated with repayments.

- Flexible Loan Amounts: Applicants can request funds between Rs. 10 lakh and Rs. 3 crore, accommodating a wide range of business needs.

- Simplified Application Process: The process is designed to be user-friendly, with online applications minimizing paperwork and bureaucratic delays.

- Merit-Based Approval: Loans are granted based on the feasibility of the business plan and the applicant’s promise, ensuring a fair and clear collection course.

CM’s Directives to the Bank of Punjab

Chief Minister Maryam Nawaz Sharif emphasised during the inauguration event the Bank of Punjab’s integral role in the efficient execution of the ‘Asaan Karobar’ Scheme. In order to ensure that money reach approved companies as soon as possible, she gave the bank orders to expedite the loan payment procedure. The CM underlined that prompt funding is necessary for the prompt creation and expansion of enterprises, which would be beneficial to the economic development of the sphere.

Land Allocation for Loan Recipients

Along with financial aid, the Punjab government promised to give Asaan Karobar borrowers of loans land in industrial zones at zero taxes. Finding affordable land for operations is one of the major obstacles faced by start-up companies, and our effort tackles that issue. The government wants to establish a favourable environment for SMEs to flourish by offering both financial and facilities support.

Economic Impact of the Scheme

The Asaan Karobar Scheme is poised to have a considerable impact on Punjab’s economy:

- Job Creation: By empowering entrepreneurs to found and expand businesses, the scheme is expected to generate many employment chances across various sectors.

- Economic Diversification: Facilitating the growth of SMEs will lead to a more diversified fiscal landscape, reducing dependence on a few trades and promoting resilience.

- Enhanced Export Potential: Support for businesses, chiefly those in export-oriented sectors, can boost the province’s export figures, causal to a promising balance of trade.

- Poverty Alleviation: Providing interest-free loans enables individuals from diverse socio-economic backgrounds to improve their livelihoods through free enterprise, thereby dipping poverty levels.

Conclusion

To encourage entrepreneurship and promote economic growth, the Punjabi government came up with the unique Asaan Karobar Scheme. The program removes significant barriers that SMEs and startups come across by providing interest-free loans, expediting the application procedure, and delivering backed rates. The government’s commitment to ensuring the scheme’s success through efficient and thorough delivery of loans is shown by Chief Minister Maryam Nawaz Sharif’s directive to the Bank of Punjab. As the initiative grows, it will prove to be crucial in empowering people, promoting sustainable development, and altering Punjab’s financial situation.

FAQs

How can I apply for the Asaan Karobar Scheme?

Interested candidates can apply online through the official website: akf.punjab.gov.pk. Ensure you meet the eligibility criteria and have all necessary certification ready before applying.

What are the eligibility requirements for the scheme?

Applicants should be inhabitants of Punjab, aged between 25 to 55 years, with a valid CNIC and NTN. They must have a clean credit history, be active tax filers with the FBR, and own or rent a business buildings within the province.

Is collateral required to secure the loan?

For loans ranging from Rs. 1 million to Rs. 5 million (Tier 1), a personal promise is sufficient. For loans between Rs. 6 million to Rs. 30 million (Tier 2), secured security is required.

What is the repayment period for the loans?

The repayment tenancy is up to 5 years, with a grace period of up to 6 months for startups and up to 3 months for existing businesses.

Are there any processing fees associated with the loan application?

Yes, there is a non-refundable dispensation fee of Rs. 5,000 for Tier 1 loans and Rs. 10,000 for Tier 2 loans.