Asaan Karobar Finance Scheme Rules Updated Today

The Punjab government’s Asaan Karobar Finance Scheme aims to boost small and medium-sized enterprises (SMEs) by providing interest-free loans. This groundbreaking initiative supports business startups, expansions, and modernizations across Punjab, creating opportunities for entrepreneurs to thrive.

Eligibility Criteria for the Asaan Karobar Finance Scheme

Applicants must meet these criteria to qualify:

- Age: Between 21 and 57 years old.

- Identification: A valid CNIC and a registered mobile number.

- Residency: Own or plan to establish a business located in Punjab.

- Tax Compliance: Must be a registered tax filer with a clean credit history.

- Business Premises: Possess ownership or rental agreements for business and residential premises.

Important Dates:

| Detail | Information |

|---|---|

| Launch Date | January 15, 2025 |

| Application Start | January 20, 2025 |

| Deadline | March 31, 2025 |

| Loan Amount (Tier 1) | PKR 1 million to PKR 5 million |

| Loan Amount (Tier 2) | PKR 6 million to PKR 30 million |

| Interest Rate | 0% (Interest-Free) |

| Submission | Online Only |

Discover how to register for the scheme here.

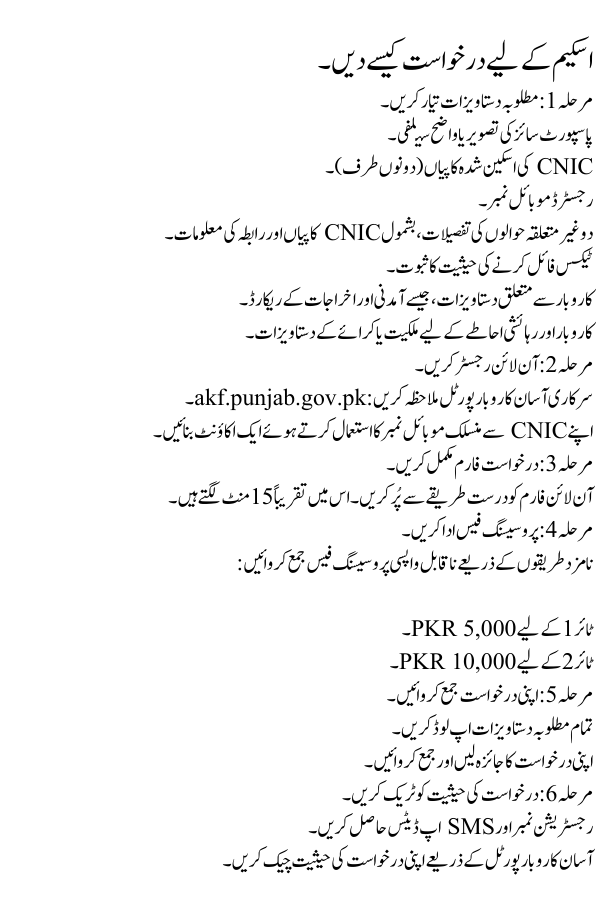

How to Apply for the Scheme

Step 1: Prepare Required Documents

- Passport-size photograph or a clear selfie.

- Scanned copies of CNIC (both sides).

- Registered mobile number.

- Details of two non-relative references, including CNIC copies and contact information.

- Proof of tax filing status.

- Business-related documents, such as income and expense records.

- Ownership or rental documents for business and residential premises.

Step 2: Register Online

- Visit the official Asaan Karobar portal: akf.punjab.gov.pk.

- Create an account using your CNIC-linked mobile number.

Step 3: Complete the Application Form

- Fill out the online form accurately. This takes approximately 15 minutes.

Step 4: Pay the Processing Fee

- Submit the non-refundable processing fee via designated methods:

- PKR 5,000 for Tier 1.

- PKR 10,000 for Tier 2.

Step 5: Submit Your Application

- Upload all required documents.

- Review and submit your application.

Step 6: Track Application Status

- Receive a registration number and SMS updates.

- Check your application status via the Asaan Karobar portal.

Learn more about the online application process.

Repayment Terms for Loans

- Interest-Free: 0% interest on loans.

- Repayment Period: Up to five years with equal monthly installments.

- Grace Period: Six months for startups and up to three months for established businesses.

- Penalty for Late Payments: Minimal charges apply for overdue amounts.

These terms provide SMEs with financial stability and flexibility. Explore the benefits of Punjab’s loan schemes.

Why the Processing Fee is Crucial

The processing fee ensures:

- Transparency: Eliminates unserious applications.

- Administrative Efficiency: Covers evaluation costs.

- Timely Reviews: Facilitates quicker processing of applications.

Paying this fee is a critical step in securing interest-free loans. Read more about loan opportunities here.

FAQs

Q1: Can non-residents of Punjab apply? A: No, only Punjab residents are eligible.

Q2: What documents are mandatory for application? A: Valid CNIC, proof of tax filing, and business documentation.

Q3: Is the processing fee refundable? A: No, the fee is non-refundable.

Q4: Are there penalties for late repayments? A: Yes, nominal charges apply for overdue amounts.

Final Words

The Asaan Karobar Finance Scheme 2025 is a transformative step by the Punjab government to empower entrepreneurs and support SMEs. By meeting the eligibility criteria and following the application process, you can access interest-free loans and unlock new opportunities for growth. Apply today and take the first step toward financial success.

Also Read: CM Maryam announces Punjab Asaan Karobar Scheme

👇👇👇

Read more: Government Schemes