Asaan Karobar Finance Scheme

The Asaan Karobar Finance Program aims to provide monetary help to small and average enterprises (SMEs) in Punjab. Under this scheme, tycoons can receive interest-free loans changing from Rs. 1,000,000 to Rs. 30,000,000 with a payment period of five years. The scheme’s purpose is to boost business expansion and create employ chances.

Quick Information Table

| Program Name | Asaan Karobar Finance Scheme |

| Start Date | Ongoing |

| End Date | Not Announced |

| Loan Amount | PKR 1M to PKR 30M |

| Interest Rate | 0% (Interest-Free) |

| Loan Tenure | Up to 5 Years |

| Application Mode | Online |

| Eligibility | Businesses in Punjab |

| Processing Fee | PKR 5,000 to PKR 10,000 |

What is the Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Programis an inventiveness by the Punjab Government intended to provide interest-free loans to SMEs in Punjab. The goal is to assist tycoons in growing their trades, making service, and increasing Punjab’s cheap.

Purpose of the Asaan Karobar Finance Program

The scheme aims to:

- Support business growth by offering nearby, interest-free financing.

- Promote economic development by funding startups and increasing trades.

- Encourage free enterprise and job creation across Punjab.

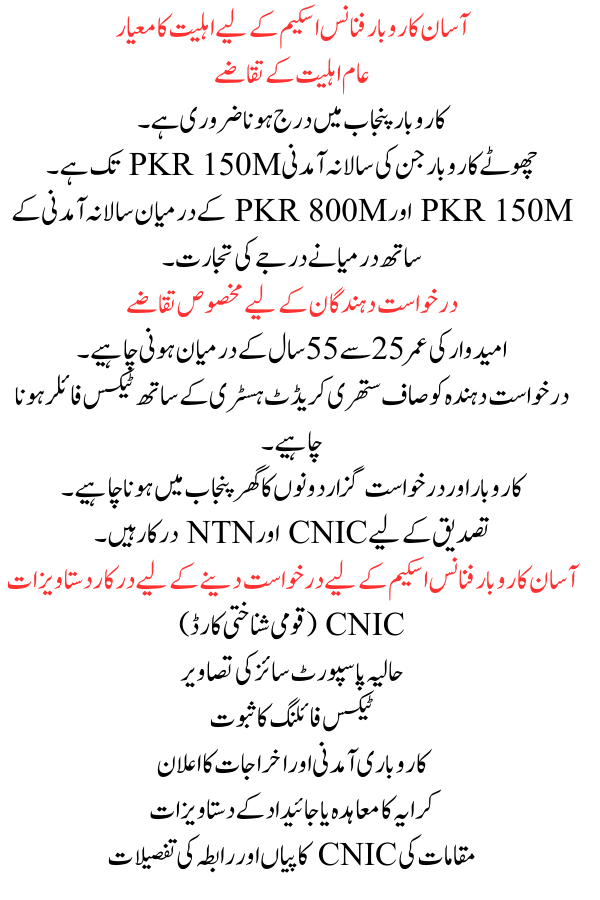

Eligibility Criteria for the Asaan Karobar Finance Scheme

General Eligibility Requirements

- The business must be listed in Punjab.

- Small businesses with annual revenue up to PKR 150M.

- Medium-sized trades with annual income between PKR 150M and PKR 800M.

Specific Requirements for Applicants

- The candidate must be between 25 to 55 years old.

- The applicant must be a tax filer with a clean credit history.

- Both the business and applicant’s house must be in Punjab.

- CNIC and NTN are required for confirmation.

Loan Details for the Asaan Karobar Finance Scheme

T1 Loan (PKR 1M to 5M)

- Security: Personal Guarantee.

- Loan Period: Up to 5 years.

- Interest Rate: 0%.

- Processing Fee: PKR 5,000.

T2 Loan (PKR 6M to 30M)

- Security: Secured Loan (requires collateral).

- Loan Period: Up to 5 years.

- Interest Rate: 0%.

- Processing Fee: PKR 10,000.

Documents Required to Apply for the Asaan Karobar Finance Scheme

- CNIC (National Identity Card)

- Recent Passport-Size Photos

- Proof of Tax Filing

- Business Income and Expense Declaration

- Rent Agreement or Property Documents

- Places’ CNIC Copies and Contact Details

How to Register for the Asaan Karobar Finance

Program

- Visit the Official Website: Go to akf.punjab.gov.pk.

- Fill Out the Registration Form: Enter your details (name, CNIC, age, email, etc.).

- Upload Required Documents: Attach CNIC, tax proof, and business documents.

- Submit the Form: Review and submit your application.

- Check Application Status: Log in using your CNIC to track progress.

How Can People Benefit from This Program?

- Interest-Free Loans: Helps businesses grow without monetary burden.

- Flexible Repayment: Up to 5 years for repayment.

- Job Creation: More businesses mean more employment chances.

- Business Expansion: Helps businesses scale up actions.

- Support for Export-Oriented Industries: Boosts Punjab’s exports.

Impact of the Asaan Karobar Finance Program on the Punjab Economy

The scheme is expected to:

- Encourage entrepreneurship and business expansion.

- Increase job chances, falling unemployment.

- Strengthen Punjab’s economy through commercial growth and exports.

Conclusion

The Asaan Karobar Finance Program is a valuable creativity for small and medium trades in Punjab. By offering interest-free loans, it helps tycoons grow their businesses, create jobs, and contribute to economic development. If you are qualified, this scheme is a golden chance to secure backing for your business without monetary strain.

FAQs

Do I need my ID to join this program?

Yes, a valid CNIC is required.

Who is eligible for this program?

Businesses in Punjab that meet the eligibility criteria, including tax compliance and revenue limits.

Are women eligible for this program?

Yes, women entrepreneurs who meet the eligibility supplies can apply.

Can unmarried women also take loans?

Yes, as long as they fulfill the eligibility criteria.