Asaan Karobar Card Loan

The Government of Punjab has presented two innovative loan schemes to support persons in starting or increasing their trades: Asaan Karobar Card Loan and Asaan Karobar Finance Loan. These creativities aim to deliver monetary help without any attention, making them an ideal choice for small and medium-sized trades. While many people think these schemes are identical, they serve different drives and have separate application processes. This guide provides a complete overview of these schemes, settling you have all the physical you need.

Quick Overview

| Program Name | Start Date | End Date | Loan Amount | Application Method |

| Asaan Karobar Card Loan | January 2025 | December 2025 | Up to PKR 10 lakh | Online |

| Asaan Karobar Finance Loan | January 2025 | December 2025 | PKR 10 lakh to PKR 3 crore | Online |

What Are Asaan Karobar Card Loan and Asaan Karobar Finance Loan?

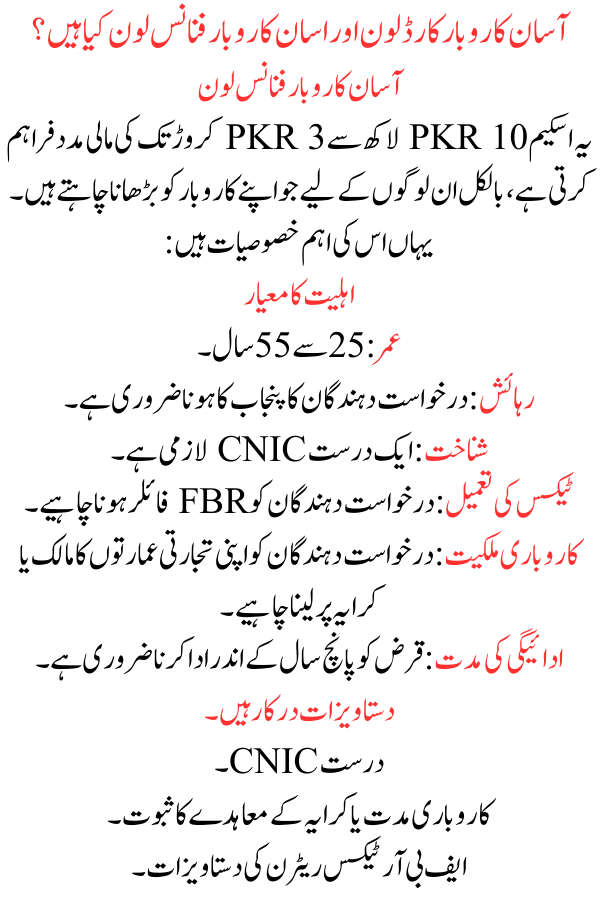

Asaan Karobar Finance Loan

This scheme provides financial help ranging from PKR 10 lakh to PKR 3 crore, exactly for folks aiming to rise their businesses. Here are its key features:

Eligibility Criteria

- Age: 25 to 55 years.

- Residence: Applicants must be people of Punjab.

- Identification: A valid CNIC is mandatory.

- Tax Compliance: Applicants must be FBR filers.

- Business Ownership: Applicants should own or rent their commercial buildings.

- Repayment Period: The loan must be repaid within five years.

Documents Required

- Valid CNIC.

- Proof of business tenure or rental agreement.

- FBR tax return documentation.

Asaan Karobar Card Loan

This loan scheme is custom-made for small business owners, offering economic help up to PKR 10 lakh. The loan is provided via a dedicated card, abridging contacts and payments.

Eligibility Criteria

- Age: 21 to 57 years.

- Residence: Applicants must be people of Punjab.

- Identification: A valid CNIC is required.

- SIM Registration: The phone number used must be listed with the applicant’s CNIC.

- Tax Compliance: Applicants must be FBR filers.

- Repayment Period: The loan must be repaid within three years.

Benefits of the Card

- Utility Payments: Can be used to pay utility bills.

- Cash Withdrawals: Allows cash removals up to the official limit.

- Business Purchases: Eases buying business-related goods.

How to Apply for These Loan Schemes?

The application process for both loans is conducted online. Each scheme has its own registering portal. Follow these step-by-step orders to apply:

Steps for Applying to Asaan Karobar Finance Loan

- Visit the Official Portal: Access the devoted website if in the loan statement.

- Fill Out the Form: Provide precise information such as your name, CNIC number, and date of birth.

- Submit Required Documents: Attach scanned copies of your CNIC, proof of business ownership, and FBR tax forms.

- Pay Processing Fee: Submit a non-refundable fee based on the loan quantity:

- PKR 5,000 for loans up to PKR 10 lakh.

- PKR 10,000 for loans up to PKR 3 crore.

- Await Approval: Applications will be reviewed, and fruitful applicants will be informed.

Steps for Applying to Asaan Karobar Card Loan

- Access the Card Loan Portal: Use the unique link if for card loans.

- Complete the Registration: Enter your details, including your listed phone number.

- Attach Documents: Upload your CNIC and any other obligatory files.

- Submit: Confirm your application and await validation.

Important Notes for Applicants

- Ensure that all information provided during registering is precise.

- FBR filer status is mandatory for both schemes. If you are not a filer, consider hiring a expert or using an online service to register as a tax filer.

- Verify that your CNIC and SIM card details are updated and valid.

- Keep track of application deadlines and respond promptly to any inquiries from the loan establishments.

Contact Information and Helpline

If you need assistance, you can contact the government helpline at 1786. Moreover, visit the official website for FAQs and detailed rules. It is recommended to check for the latest updates to avoid missing any important information.

Conclusion

The Asaan Karobar Card Loan and Asaan Karobar Finance Loan are radical initiatives by the Punjab Government future to empower small and medium-sized businesses. By offering interest-free loans, these schemes provide a unique opportunity for persons to increase their operations or start new schemes without monetary stress.

If you meet the aptness criteria, make sure to apply through the honest portal and seize this chance to reach your business goals. Spread the word about these useful posts to help others take benefit of them as well.