Asaan Karobaar Card Scheme Revealed 2025

The Government of Punjab has presented the highly expected Asaan Karobaar Card Scheme Revealed 2025, an creativity designed to allow small tycoons across the area. This scheme offers interest-free loans of up to PKR 1 million, if a important boost to business growth and financial development. With a structured refund plan and easy access to credit, this initiative is set to transform the small business scenery in Punjab.

Quick Information Table

| Program Name | Asaan Karobaar Card Scheme 2025 |

| Start Date | January 1, 2025 |

| End Date | December 31, 2025 |

| Loan Amount | Up to PKR 1 million |

| Interest Rate | 0% |

| Application Method | Online through the PITB portal |

| First Installment Due | April 1, 2025 (3-month grace period) |

| Repayment | Monthly installments over 3 years |

Key Features of the Asaan Karobaar Card Scheme

The Asaan Karobaar Card Scheme stands out for its entrepreneur-friendly features:

- Loan Limit: Up to PKR 1 million

- Loan Tenure: 3 years

- Loan Type: Revolving credit facility for 12 months

- Interest Rate: 0%

- Grace Period: 3 months before the first payment is due

- Flexible Repayment: Easy monthly parts based on usage

Key Details

Here are the essential details of the scheme:

| Details | Information |

| Application Start Date | January 1, 2025 |

| First Installment Due | April 1, 2025 (3-month grace period) |

| Loan Limit Access | 50% in the first 6 months; remaining 50% upon compliance |

| Repayment Method | Monthly installments over 3 years |

| Last Application Date | December 31, 2025 |

| Eligibility Age | 21-57 years |

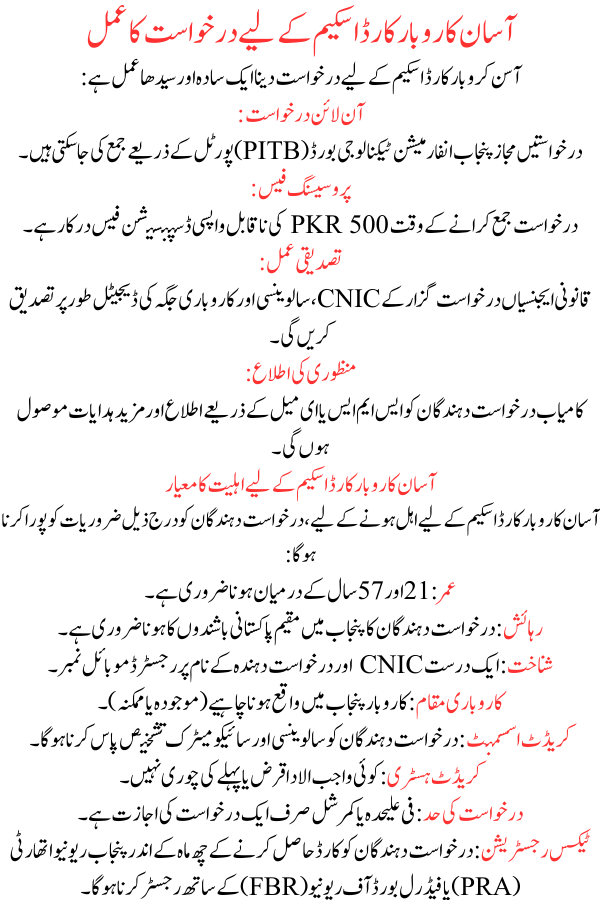

Eligibility Criteria for the Asaan Karobaar Card Scheme

To qualify for the Asaan Karobaar Card Scheme, applicants must meet the following requirements:

- Age: Must be between 21 and 57 years old.

- Residency: Applicants must be Pakistani residents residing in Punjab.

- Identification: A valid CNIC and a mobile number registered in the applicant’s name.

- Business Location: The business must be located in Punjab (existing or prospective).

- Credit Assessment: Applicants must pass a solvency and psychometric appraisal.

- Credit History: No overdue loans or prior evasions.

- Application Limit: Only one application is allowed per separate or commercial.

- Tax Registration: Applicants must register with the Punjab Revenue Authority (PRA) or Federal Board of Revenue (FBR) within six months of getting the card.

Loan Usage and Repayment Details

The Asaan Karobaar Card Scheme Revealed ensures that funds are used efficiently for business growth. Here’s how the loan can be used and repaid:

Permissible Uses

The loan can be used for the following business-related purposes:

- Payments to vendors and suppliers

- Utility bills, government fees, and taxes

- Cash withdrawals (up to 25% of the approved limit) for various business needs

Restricted Uses

The loan cannot be used for:

- Personal expenses such as household bills or entertainment

- Non-business-related businesses

Repayment Schedule

The repayment plan is designed to be flexible and helpful of business cash flows:

- Initial Limit Access:

- Borrowers can access 50% of the official loan limit within the first 6 months.

- Grace Period:

- A 3-month grace period is if after the issuance of the card before repayments begin.

- Monthly Installments:

- After the grace period, borrowers are required to repay at least 5% of the outstanding amount (principal only) each month through the first year.

- Additional Limit Access:

- The remaining 50% of the loan becomes nearby upon meeting compliance requirements, such as timely repayments and tax registering with PRA/FBR.

- Full Repayment:

- The remaining balance is repaid in equal monthly parts over the next 2 years.

Application Process for the Asaan Karobaar Card Scheme

Applying for the Asaan Karobaar Card Scheme Revealed is a simple and straightforward process:

- Online Application:

- Applications can be submitted via the authorized Punjab Info Technology Board (PITB) portal.

- Processing Fee:

- A non-refundable dispensation fee of PKR 500 is required at the time of application submission.

- Verification Process:

- Lawful agencies will digitally verify the applicant’s CNIC, solvency, and business premises.

- Approval Notification:

- Successful applicants will receive notification and further instructions via SMS or email.

Conclusion

The Asaan Karobaar Card Scheme Revealed 2025 is a game-changing inventiveness by the Government of Punjab, aimed at authorizing small tycoons and boosting the province’s economy. With its interest-free loans, structured repayment plan, and focus on promoting accountable borrowing, the scheme ensures that trades have the financial support they need to thrive.

This comprehensive guide has covered all you need to know about the program, from suitability criteria to application procedures. With this inventiveness, small businesses in Punjab can look forward to a happier and more wealthy future.