Apply for the CM Punjab Asaan Karobar Scheme

The Government of Punjab’s CM Punjab Asaan Karobar Scheme is an innovative initiative for secondary medium-sized enterprises (SMEs) that aims to approve startups, current companies, and promising entrepreneurs via interest-free loans and digital SME cards. The scheme’s primary goals are to support business growth in Punjab, create appealing jobs, and foster revenue growth..

To get the benefits of the scheme, applicants must apply by March 31, 2025. You won’t have to look far for broad details about the Apply for the CM Punjab Asaan Karobar Scheme because this thorough primer will tell you all you need to know.

Key Details of the Scheme

| Feature | Details |

| Total Budget | PKR 84 billion |

| Loan Amount | PKR 1 million to PKR 30 million |

| Processing Fee | PKR 500 to PKR 10,000 |

| Application Deadline | March 31, 2025 |

| Start Date | January 20, 2025 |

| Method of Application | Online |

Application Timeline

On January 20, 2025, the Apply for the CM Punjab Asaan Karobar Scheme application season started, and it would end on March 31, 2025. In order to avoid last-minute problems or possible processing delays, applicants are urged to submit their applications as soon as feasible..

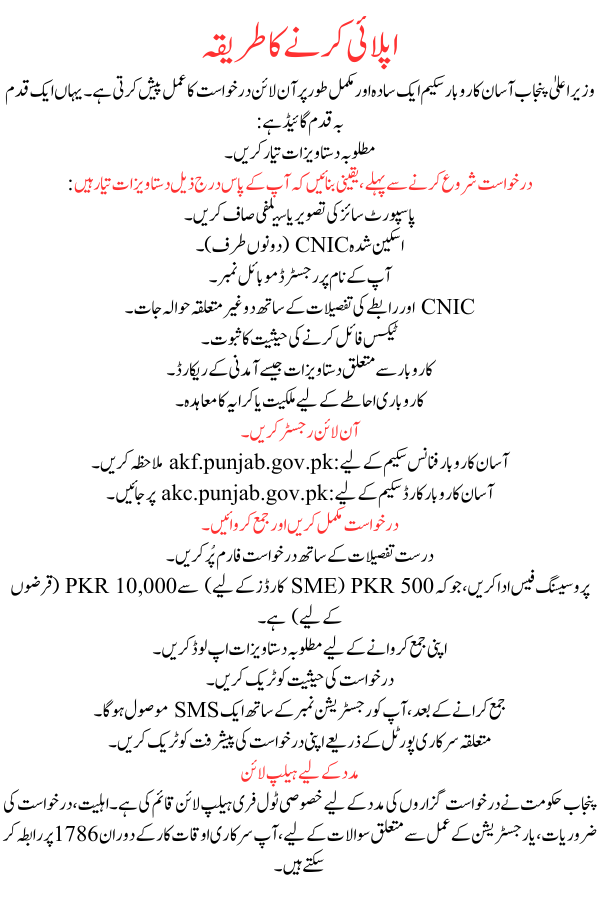

How to Apply

The Apply for the CM Punjab Asaan Karobar Scheme offers a simple and entirely online application process. Here’s a step-by-step guide:

- Prepare Required Documents

Before starting the application, ensure you have the following documents ready:

- Clear passport-size photograph or selfie.

- Scanned CNIC (both sides).

- Mobile number registered in your name.

- Two non-relative references with CNIC and contact details.

- Proof of tax filing status.

- Business-related documents such as income records.

- Ownership or rental agreement for business premises.

- Register Online

- For Asaan Karobar Finance Scheme: Visit akf.punjab.gov.pk.

- For Asaan Karobar Card Scheme: Visit akc.punjab.gov.pk.

- Complete and Submit the Application

- Fill out the application form with accurate details.

- Pay the processing fee, which ranges from PKR 500 (for SME cards) to PKR 10,000 (for loans).

- Upload the required documents to complete your submission.

- Track Application Status

- After submission, you’ll receive an SMS with a registration number.

- Track your application’s progress through the respective official portal.

Helpline for Assistance

The Punjab government has set up a special toll-free helpline to assist applicants. For queries regarding eligibility, application requirements, or the registration process, you can contact 1786 during official business hours.

Benefits of the Scheme

The Apply for the CM Punjab Asaan Karobar Scheme is a game-changing initiative with the following key benefits:

- Interest-Free Loans

- Loans ranging from PKR 1 million to PKR 30 million are available for eligible entrepreneurs.

- Digital SME Card

- The Asaan Karobar Card provides access to convenient payment options and credit facilities, tailored to the needs of startups and small businesses.

- Economic Inclusion

- The scheme actively encourages participation from women, transgender individuals, and persons with disabilities, ensuring equal opportunities for all.

- Business Growth Opportunities

- With accessible financing, entrepreneurs can scale their businesses, create employment opportunities, and contribute to economic growth.

Conclusion

An broad program that encourages economic growth and entrepreneurial development in Punjab is the CM Punjab Asaan Karobar Scheme. Its no-interest financing and easy online application process make it an appealing choice for startups and SMEs.

However, late entries will not be permitted, and the application deadline is March 31, 2025. Thus, suitable applicants are encouraged to move promptly in order to take benefit of this outstanding program and effectively expand their businesses.

FAQs

What is the total budget allocated for this scheme?

The scheme has a total budget of PKR 84 billion, with PKR 48 billion reserved for the Asaan Karobar Card Scheme.

Who can apply for the scheme?

Both new and existing businesses in Punjab, counting women, transgender persons, and persons with infirmities, are entitled.

What is the loan amount range?

Applicants can receive loans between PKR 1 million and PKR 30 million, contingent on their business needs and eligibility.

Is it possible to apply for both the Finance and Card Schemes?

Yes, eligible applicants can apply for both mechanisms of the scheme.

What happens if I miss the application deadline?

Applications succumbed after March 31, 2025, will not be considered, so it’s vital to complete your suggestion on time.