Punjab Asaan Karobar Loan Scheme

The CM Punjab Asaan Karobar Loan Scheme Program 2025 is a radical creativity by the Punjab Government aimed at improving small and medium-sized businesses. This program offers interest-free loans to help tycoons start, expand, or update their trades, ultimately causal to economic growth in Punjab.

Quick Information Table

| Program Name | CM Punjab Asaan Karobar Loan Scheme Program 2025 |

| Start Date | January 2025 |

| End Date | December 2025 |

| Loan Amount | PKR 1 million to PKR 30 million |

| Interest Rate | 0% (interest-free loans) |

| Application Method | Online via the official portal |

| Processing Fee | PKR 5,000 to PKR 10,000 (non-refundable) |

Purpose of the Program

The Asaan Karobar Loan Scheme serves numerous key purposes:

- Startup Support

The program aims to assist new tycoons by providing the wealth needed to launch their businesses.

- Business Expansion

Existing trades can leverage these loans to increase their actions, hire more staffs, or invest in technology.

- Leasing Facilities

Funds are obtainable to help businesses lease profitable spaces or gear vital for growth.

- Environmental Sustainability

Special inducements are provided to businesses directing on eco-friendly keys and green projects.

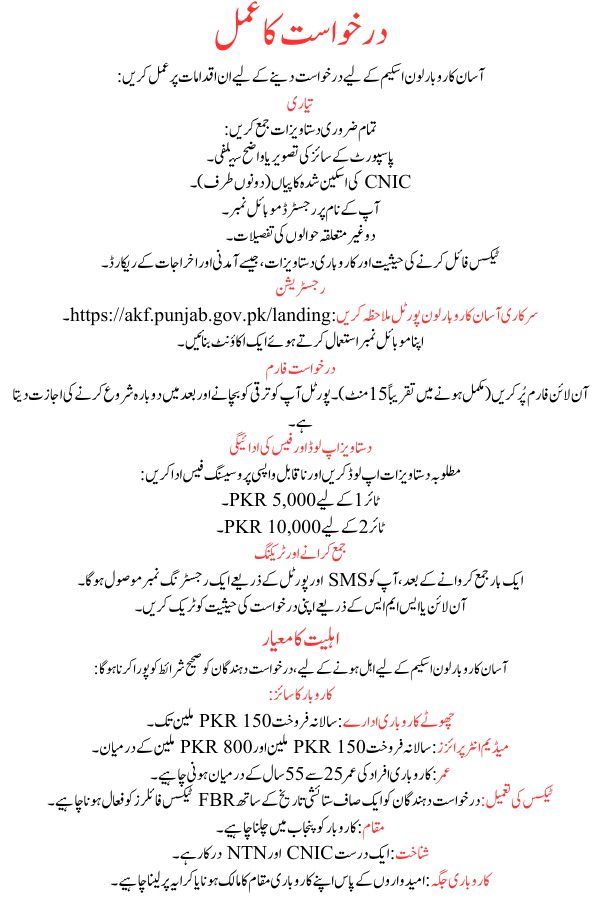

Eligibility Criteria

To qualify for the Asaan Karobar Loan Scheme, applicants must meet exact conditions:

- Business Size:

- Small Enterprises: Annual sales up to PKR 150 million.

- Medium Enterprises: Annual sales between PKR 150 million and PKR 800 million.

- Age: Entrepreneurs must be between 25 and 55 years old.

- Tax Compliance: Applicants must be active FBR tax filers with a clean praise history.

- Location: The business must operate within Punjab.

- Identification: A valid CNIC and NTN are required.

- Business Premises: Candidates must own or rent their business location.

Loan Details

The program offers two separate tiers of loans, each with specific terms:

Tier 1 (T1)

- Loan Amount: PKR 1 million to PKR 5 million.

- Security: Personal guarantee required.

- Tenure: Up to 5 years.

- Interest Rate: 0% (interest-free).

- Processing Fee: PKR 5,000 (non-refundable).

Tier 2 (T2)

- Loan Amount: PKR 6 million to PKR 30 million.

- Security: Collateral required.

- Tenure: Up to 5 years.

- Interest Rate: 0% (interest-free).

- Processing Fee: PKR 10,000 (non-refundable).

Additional Financial Terms

Grace Period

- Startups: Up to 6 months.

- Existing businesses: Up to 3 months.

Equity Contribution

- No contribution required for T1 loans, except for leased vehicles (25% equity).

- 20% equity contribution for T2 loans.

- Reduced equity input (10%) for women, transgender persons, and differently-abled persons.

Repayment

- Loans are repaid in equal monthly payments as agreed.

Late Payment Charges

- PKR 1 per PKR 1,000 per day for late repayments.

Additional Costs

- No annual fee for new businesses and green projects.

- 3% per annum annual fee for existing businesses under T2.

- Legal, insurance, and recording fees apply based on actual costs.

Application Process

Follow these steps to apply for the Asaan Karobar Loan Scheme:

- Preparation

Gather all required documents:

- Passport-sized photo or a clear selfie.

- Scanned copies of CNIC (both sides).

- A mobile number registered in your name.

- Details of two non-relative references.

- Tax filing status and business documents, such as income and expenditure records.

- Registration

- Visit the official Asaan Karobar Loan Portal: https://akf.punjab.gov.pk/landing.

- Create an account using your mobile number.

- Application Form

- Fill out the online form (approximately 15 minutes to complete). The portal allows you to save development and resume later.

- Document Upload and Fee Payment

- Upload required documents and pay the non-refundable processing fee:

- PKR 5,000 for Tier 1.

- PKR 10,000 for Tier 2.

- Submission and Tracking

- Once submitted, you will receive a registering number via SMS and the portal.

- Track your application status online or via SMS.

Benefits of the Program

- Interest-Free Loans: No financial burden from attention payments.

- Inclusive Approach: Special terms for women, transgender individuals, and differently-abled persons.

- Convenient Process: Fully digital application process reduces hassle.

- Economic Growth: Boosts entrepreneurship and employment in Punjab.

Conclusion

The CM Punjab Asaan Karobar Loan Scheme Program 2025 is a golden chance for entrepreneurs and trades in Punjab to achieve their goals without fiscal stress. This creativity not only cares discrete growth but also pays shrewdly to the region’s financial development. By providing interest-free loans and an easy application process, the program ensures inclusivity and convenience for all eligible persons.