Pk Login for Asaan Karobar Card

The Punjab government, under the leadership of Chief Minister Maryam Nawaz Sharif, has launched the Asaan Karobar Card Loan Scheme to provision free enterprise and small businesses in the region. This creativity offers interest-free loans reaching from Rs. 100,000 to Rs. 1 million, providing a fantastic chance for aspiring tycoons to grow their businesses.

In this article, we will provide full guidance on registration for the Asaan Karobar Card, its features, eligibility criteria, loan usage, payment terms, and much more. By the end of this guide, you’ll have all the information you need to make the most of this implausible program.

Quick Overview

| Program Name | Asaan Karobar Card Loan Scheme 2025 |

| Start Date | January 2025 |

| End Date | December 2025 |

| Loan Amount | Rs. 100,000 to Rs. 1 million |

| Interest | 0% (Interest-Free Loan) |

| Application Method | Online via https://akc.punjab.gov.pk |

| Processing Fee | Rs. 500 (Non-Refundable) |

What is the Asaan Karobar Card?

The Pk Login for Asaan Karobar Card is a groundbreaking creativity by the Punjab government intended to empower young tycoons and small business owners. By offering interest-free loans, the program aims to remove financial barriers for persons who want to found or enlarge their businesses.

Key Benefits of the Asaan Karobar Card

- Loan Amount: Avail loans from Rs. 100,000 to Rs. 1 million.

- Repayment Tenure: Flexible repayment over three years, counting a three-month grace period.

- 0% Interest: Completely interest-free, making it an ideal choice for startups and small businesses.

- Business Support: Use funds for vendor payments, utility bills, gear grasps, or other business needs.

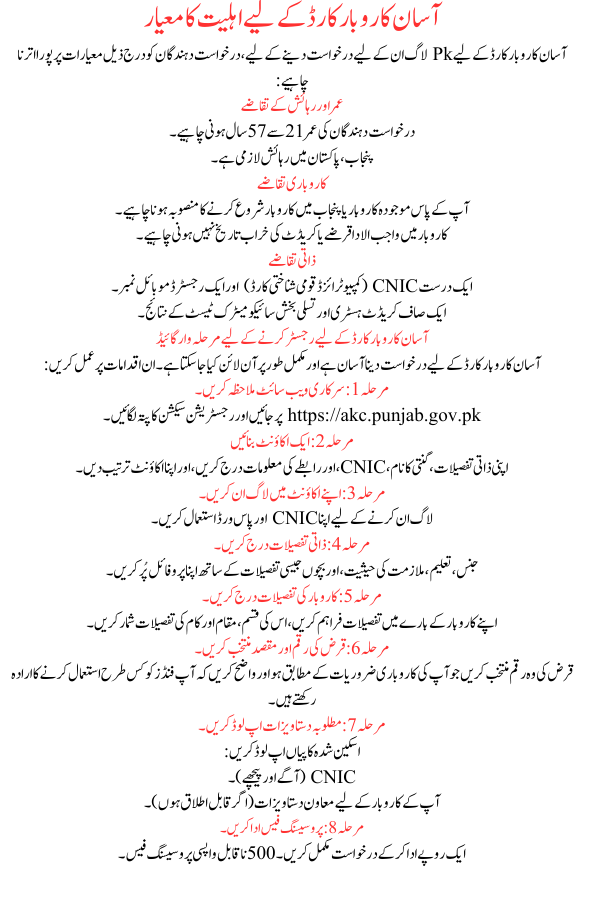

Eligibility Criteria for the Asaan Karobar Card

To apply for the Pk Login for Asaan Karobar Card, applicants must meet the following criteria:

Age and Residency Requirements

- Applicants must be aged 21 to 57 years.

- Residency in Punjab, Pakistan is mandatory.

Business Requirements

- You must have an existing business or a plan to start a business in Punjab.

- The business must not have overdue loans or a bad credit history.

Personal Requirements

- A valid CNIC (Computerized National Identity Card) and a registered mobile number.

- A clean credit history and satisfactory psychometric test results.

Step-by-Step Guide to Register for the Asaan Karobar Card

Applying for the Asaan Karobar Card is simple and can be done totally online. Follow these steps:

Step 1: Visit the Official Website

Go to https://akc.punjab.gov.pk and locate the registration section.

Step 2: Create an Account

Enter your personal details, counting name, CNIC, and contact info, and set up your account.

Step 3: Log In to Your Account

Use your CNIC and password to log in.

Step 4: Enter Personal Details

Fill out your profile with details such as gender, education, employment status, and children.

Step 5: Enter Business Details

Provide specifics about your business, counting its type, location, and working details.

Step 6: Select Loan Amount and Purpose

Choose the loan amount that suits your business needs and clarify how you plan to use the funds.

Step 7: Upload Required Documents

Upload scanned copies of:

- CNIC (front and back).

- Supporting documents for your business (if applicable).

Step 8: Pay Processing Fee

Complete the request by paying a Rs. 500 non-refundable processing fee.

Loan Usage and Repayment Terms

Loan Usage

- The loan will be disbursed in two parts: 50% upfront and 50% after six months, provided you meet the conditions.

- Funds can be used for business expenses such as buying gear, paying bills, or expanding operations.

Repayment Terms

- The repayment period is three years, with a three-month grace period.

- Equal monthly payments must be made, with a minimum payment of 5% of the loan balance each month.

Key Features and Restrictions

- Annual Card Fee: Rs. 25,000 + FED will be took from the loan amount.

- Late Payment Charges: Applicable as per the bank’s policy.

- Usage Restrictions: Funds must strictly be used for business-related doings.

Additional Support for Applicants

The Punjab government offers additional resources to ensure candidates succeed:

- Feasibility Studies: Available on the PSIC and Bank of Punjab websites to guide new businesses.

- Advisory Services: Assistance in business registration and fund use.

Conclusion

The Pk Login for Asaan Karobar Card Loan Scheme is a amazing step toward development free enterprise in Punjab. With its easy application process, interest-free loans, and flexible payment terms, it offers an unparalleled chance for young business owners and startups.

If you’re ready to take your business to the next level, don’t wait. Visit https://akc.punjab.gov.pk today to apply and unlock your business potential.

FAQs

What is the Pk Login for Asaan Karobar Card?

The Pk Login for Asaan Karobar Card is a loan scheme by the Punjab Government offering interest-free loans to small businesses and tycoons.

What is the maximum loan amount available?

Loans range from Rs. 100,000 to Rs. 1 million.

How can I apply for the Asaan Karobar Card?

Visit the official website, create an account, fill out the claim form, upload the required documents, and pay the dispensation fee.

Is the loan interest-free?

Yes, the loan is completely interest-free.

Are there any restrictions on how the loan can be used?

Yes, funds must strictly be used for business-related expenses.

میں نےآسان کاروبار قرضہ کے لیے اپلاٸی کیا ہے اگلے مرحلے کے لیے میسج بھی آگیا ہے مگر دوبارہ لاگ ان نہی ہورہا ویب ساٸٹ جام ہوجاتی کیا وجہ ہوسکتی?