Asaan Karobar Loan Recipients

In a significant move to bolster free enterprise in Punjab, Chief Minister Maryam Nawaz Sharif has unveiled a comprehensive creativity under the Asaan Karobar Loan Recipients Scheme. This package not only offers interest-free loans to hopeful tycoons but also allots land in trade zones to ease business operations. The statement was made during a cheque and card supply rite, emphasizing the government’s pledge to economic growth and support for small and medium-sized initiatives (SMEs).

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Asaan Karobar Scheme | February 2025 | Ongoing | Rs. 1 million to Rs. 30 million | Online |

| Free Plot Scheme | Ramadan 2025 | To be announced | Land allocation in industrial zones | To be announced |

| Financial Assistance Program | Ramadan 2025 | To be announced | Rs. 10,000 per family | To be announced |

| Laptop Distribution Scheme | Post-Ramadan 2025 | To be announced | Not specified | To be announced |

Overview of the Asaan Karobar Scheme

The Asaan Karobar Loan Recipients Scheme is designed to deliver monetary support to small and medium-sized tycoons in Punjab. The program offers interest-free loans ranging from Rs. 1 million to Rs. 30 million, repayable over a period of up to five years. This creativity aims to rouse economic growth by enabling tycoons to create and expand their businesses without the burden of interest payments.

Land Allocation in Industrial Zones

A notable feature of the scheme is the distribution of land within trade zones for loan recipients. This provision ensures that entrepreneurs have access to the necessary substructure to begin their business operations punctually. The government has stressed a ‘Zero Time to Start’ policy, enabling instant business start upon loan approval.

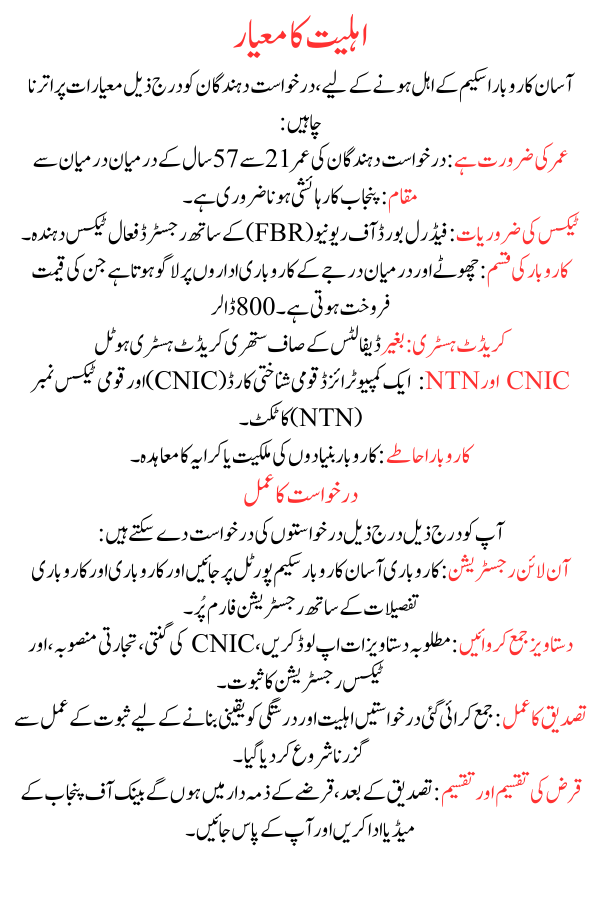

Eligibility Criteria

To qualify for the Asaan Karobar Scheme, applicants must meet the following criteria:

- Age Requirement: Applicants should be between 21 to 57 years old.

- Residency: Must be a resident of Punjab.

- Tax Status: Active taxpayer registered with the Federal Board of Revenue (FBR).

- Business Type: Applicable to small and medium-sized enterprises with annual sales up to Rs. 800 million.

- Credit History: Must have a clean credit history with no defaults.

- CNIC and NTN: Possession of a valid Computerized National Identity Card (CNIC) and National Tax Number (NTN).

- Business Premises: Ownership or rental agreement of the business grounds.

Application Process

Interested applicants can apply through the following steps:

- Online Registration: Visit the official Asaan Karobar Scheme portal and fill out the registration form with individual and business details.

- Document Submission: Upload required documents, counting CNIC, business plan, and proof of tax registration.

- Verification Process: Submitted applications will undergo a proof process to ensure eligibility and validity.

- Loan Approval and Disbursement: Upon successful verification, loans will be official and paid through the Bank of Punjab.

Required Documents

Applicants need to provide the following documents:

- Personal Identification: Valid CNIC.

- Photographs: Recent passport-sized photographs.

- Tax Documents: Proof of active taxpayer status and NTN certificate.

- Business Plan: Detailed proposal outlining the business idea and operation strategy.

- References: Names, CNIC copies, and contact information of two non-family positions.

- Contact Information: Mobile number registered with the applicant’s CNIC.

Frequently Asked Questions (FAQs)

What is the repayment period for the Asaan Karobar loans?

The loans are repayable over a period of up to five years.

Are these loans interest-free?

Yes, the loans provided under the Asaan Karobar Scheme are interest-free.

Can individuals from other provinces apply for this scheme?

No, the scheme is exclusively for residents of Punjab.

Is collateral required to secure the loan?

The scheme does not specify the need for collateral; however, applicants must meet all eligibility criteria and provide necessary certification.

How long does the application process take?

The government aims to process and disburse loans within one month of application proposal.

Conclusion

Under the guidance of Chief Minister Maryam Nawaz Sharif, the Asaan Karobar Loan Recipients Scheme is a major attempt to give Punjabi tycoons more control. The initiative addresses major obstacles encountered by SMEs by offering interest-free loans and assigning land in industrial zones. This project has the potential to boost employment, stimulate economic growth, and raise living standards in the area. Aspiring business owners are urged to utilise this full support in order to fulfil their business goals.