Asan Karobar Card Loan Scheme

The Asaan Karobar Card Loan Scheme is a innovative creativity launched by Punjab Chief Minister Maryam Nawaz Sharif in January 2025. This program aims to authorize small and medium-sized initiatives (SMEs) across Punjab by if interest-free loans, thereby fostering economic growth and pretty financial presence in the area.

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Asaan Karobar Card Loan Scheme | January 16, 2025 | Ongoing | Up to Rs. 30 million (interest-free) | Online |

Objectives of the Scheme

The Asaan Karobar Card Loan Scheme is designed with several key objectives:

- Empowering Entrepreneurs: Providing monetary support to small business owners, especially youth and women, to help them enlarge their initiatives.

- Boosting the Local Economy: Inspiring economic activity in Punjab by secondary SMEs, which are vital for job creation and economic change.

- Promoting Financial Inclusion: Confirming that underserved groups have access to fiscal resources, thereby reducing economic differences.

Key Features of the Asaan Karobar Card Loan Scheme

The Asaan Karobar Card Loan scheme offers several notable features:

- Interest-Free Loans: Loans ranging from Rs. 500,000 to Rs. 30 million are provided without any interest, easing the monetary burden on businesspersons.

- Digital Application Process: Applicants can apply online through the official portal, reform the process and plummeting form-filling.

- Flexible Loan Limits: Small businesses can access loans between Rs. 100,000 and Rs. 1 million, while medium-sized initiatives can avail up to Rs. 30 million.

- Revolving Credit Facility: The scheme offers a rotating credit facility for 12 months, allowing businesses to manage their cash flow efficiently.

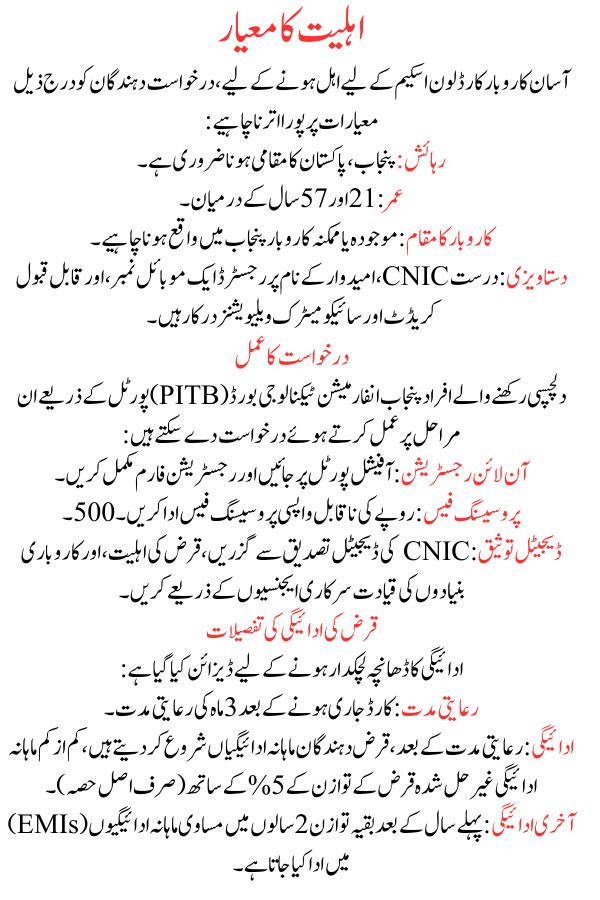

Eligibility Criteria

To qualify for the Asaan Karobar Card Loan Scheme, applicants must meet the following criteria:

- Residency: Must be a local of Punjab, Pakistan.

- Age: Between 21 and 57 years old.

- Business Location: The existing or potential business should be located in Punjab.

- Documentation: Valid CNIC, a mobile number registered in the candidate’s name, and acceptable credit and psychometric valuations are required.

Application Process

Interested persons can apply through the Punjab Information Technology Board (PITB) portal by following these steps:

- Online Registration: Visit the official portal and complete the registering form.

- Processing Fee: Pay a non-refundable processing fee of Rs. 500.

- Digital Verification: Undergo digital confirmation of CNIC, creditworthiness, and business grounds lead by official agencies.

Loan Repayment Details

The repayment structure is designed to be flexible:

- Grace Period: A 3-month grace period after card issuance.

- Repayment: After the grace period, borrowers start paying monthly payments, with a minimum monthly payment of 5% of the unresolved loan balance (principal portion only).

- Final Repayment: The remaining equilibrium after the first year is repaid over 2 years in Equal Monthly Payments (EMIs).

Benefits of the Scheme

The Asaan Karobar Card Loan Scheme offers numerous advantages:

- Financial Support: Provides essential capital for business growth, equipment purchase, or operational needs.

- Economic Growth: By empowering SMEs, the scheme donates to job formation and economic development in Punjab.

- Inclusive Growth: Special focus on youth and women entrepreneurs promotes comprehensive economic sharing.

Support and Guidance for Applicants

The Punjab government has traditional support machines to assist applicants:

- Training Programs: Business running and financial literacy training to help entrepreneurs effectively utilize the loans.

- Help Centers: Dedicated centers to provide help with the application process and answer queries.

Conclusion

The Asaan Karobar Card Loan Scheme is a important step towards authorizing small and medium-sized businesses in Punjab. By offering interest-free loans with flexible terms and a efficient application process, the scheme aims to foster financial growth and endorse financial inclusion. Magnates are fortified to take benefit of this opportunity to enlarge their businesses and contribute to the province’s wealth.

Aoa, I m Hafiz Muhammad Ahmad, age 39, live in Lahore. I am doing work related to IT , but jis main , Online Quran Academy,bhi hay, and Dispatch office bhi hay, mujhy apnay kaam ko chalanay Kay lia small amount of loan chahiyea, jis say main apnay work ko continue kersakoun. About 3 to 4 million needed.

I have all documents related to my studies and Work. So plz CM PUNJAB, kindly help me,

Regards,

Hafiz Muhammad Ahmad.