Bank of Punjab Car Loan Scheme 2025

In today’s era of rising rise, possessing a car has become a need for many families and trades in Pakistan. However, purchasing a vehicle on installments usually involves high-interest rates, making it challenging for many. Knowing this issue, the Government of Punjab, in collaboration with the Bank of Punjab (BOP), has introduced an interest-free car loan scheme. This creativity aims to provide reasonable financing solutions to eligible residents of Punjab. In this article, we will explore the details of this scheme, counting eligibility criteria, payment plans, and normally asked questions.

Quick Information Table

| Program Name | Start Date | End Date | Assistance Amount | Application Method |

| Bank of Punjab Car Loan Scheme 2025 | January 1, 2025 | December 31, 2025 | Up to PKR 2,500,000 | Online and Offline |

What is the Bank of Punjab Car Loan Scheme?

The Bank of Punjab Car Loan Scheme (BOP), in collaboration with the Punjab government, has launched a 0% interest-free car financing scheme. This initiative is designed to help individuals acquire vehicles without the burden of conventional bank interest or markup fees. Currently, the scheme covers two specific vehicle models:

- Changan Karvaan Plus (a family minivan)

- Changan M9 Shehzore (a commercial loader vehicle)

This scheme is particularly beneficial for relations needing a reliable conveyance option and tycoons looking for profitable vehicles.

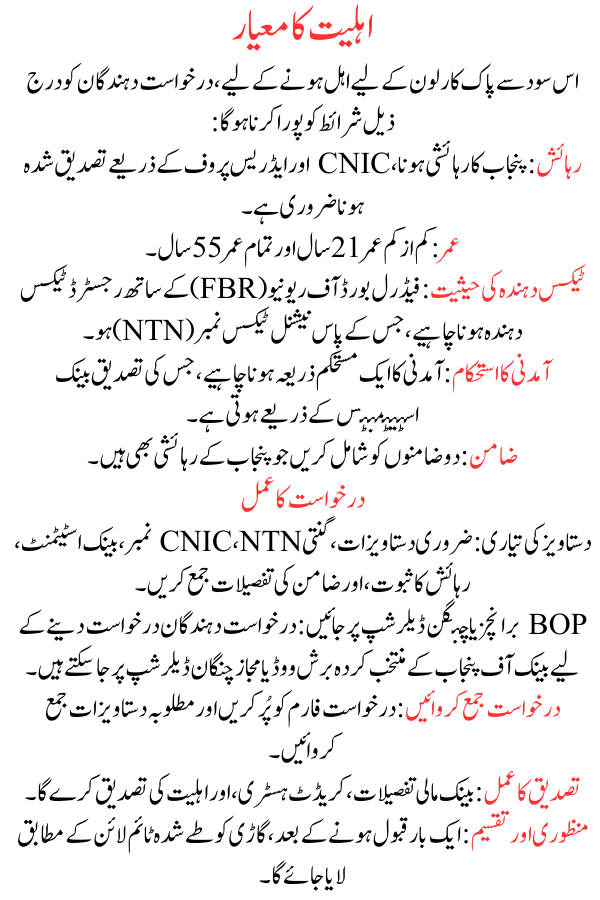

Eligibility Criteria

To qualify for this interest-free car loan, applicants must meet the following conditions:

- Residency: Must be a resident of Punjab, verified through CNIC and address proof.

- Age: Minimum age of 21 years and all-out age of 55 years.

- Taxpayer Status: Must be a taxpayer registered with the Federal Board of Revenue (FBR), possessing a National Tax Number (NTN).

- Income Stability: Must have a stable source of income, confirmed through bank statements.

- Guarantors: Entail two guarantors who are also residents of Punjab.

Down Payment and Installment Plan

While the scheme is interest-free, a considerable down payment is required. The financial breakdown is as follows:

- Changan Karvaan Plus:

- Approximate total cost: PKR 3,000,000

- Down payment: PKR 850,000

- Changan M9 Shehzore:

- Approximate total cost: PKR 2,500,000

- Down payment: PKR 750,000

The remaining amount is financed by the Bank of Punjab on a zero-interest payment plan. Additionally, the scheme includes costs for:

- Vehicle Registration

- Tracker Installation

- Comprehensive Insurance

Application Process

- Document Preparation: Gather necessary documents, counting CNIC, NTN number, bank statements, proof of residence, and guarantors’ details.

- Visit BOP Branches or Changan Dealerships: Applicants can visit chosen brushwood of the Bank of Punjab or authorized Changan dealerships to apply.

- Submit Application: Fill out the application form and submit the required documents.

- Verification Process: The bank will verify financial details, credit history, and eligibility.

- Approval & Disbursement: Once accepted, the vehicle will be brought as per the decided timeline.

Frequently Asked Questions (FAQs)

Can residents outside Punjab apply for this scheme?

No, this scheme is wholly for residents of Punjab. However, persons exist in outdoor Punjab may apply if they have a close domestic member (e.g., spouse, parents, or siblings) residing in Punjab.

Can overseas Pakistanis avail this scheme?

Yes, overseas Pakistanis can apply, but they must be bodily present in Pakistan to complete the process. Alternatively, they can apply under the name of an fit family member happen in in Punjab.

Can government employees apply?

Yes, government employees can apply, if they meet the suitability criteria and succumb the obligatory leaflets.

Is there an option to finance other vehicles under this scheme?

Currently, only Changan Karvaan Plus and Changan M9 Shehzore are comprised in the scheme. Other vehicles can be financed through BOP, but they will be subject to normal care rates.

What if I do not have a permanent house in Punjab?

Smooth if you do not own a house in Punjab, you can still apply, if you have a valid rental agreement within the area.

Conclusion

The Bank of Punjab’s 0% interest-free car loan scheme is a estimable creativity for persons seeking reasonable vehicle backing. With no markup costs and a prearranged payment plan, it provides an outstanding opportunity for families and business owners in Punjab to acquire vehicles without financial strain. If you meet the eligibility criteria, this scheme can be a viable solution for your transport needs