CM Laptop Scheme 2025 The Punjab rule has officially launched the Chief Minister’s (CM) Laptop Scheme 2025, aiming to distribute 110,000 latest-generation …

How to Apply for Punjab Asaan Karobar Finance Scheme

Punjab’s government has officially launched the Asaan Karobar Finance Scheme, aimed at making business loans accessible for the residents of Punjab. This initiative is tailored to assist individuals seeking financial support to grow or establish their businesses. If you are a resident of Punjab with a valid domicile, you can easily apply for this scheme online. Here’s a step-by-step guide to ensure a smooth application process.

Overview of the Scheme

The Asaan Karobar Finance Scheme provides financial assistance with minimal complications. Applicants can apply for loans under two tiers:

- Tier 1: Loan amounts ranging from PKR 100,000 to PKR 500,000.

- Tier 2: Loan amounts ranging from PKR 600,000 to PKR 3,000,000.

This article will walk you through the key steps, eligibility criteria, and instructions to apply without errors.

Essential Documents Required

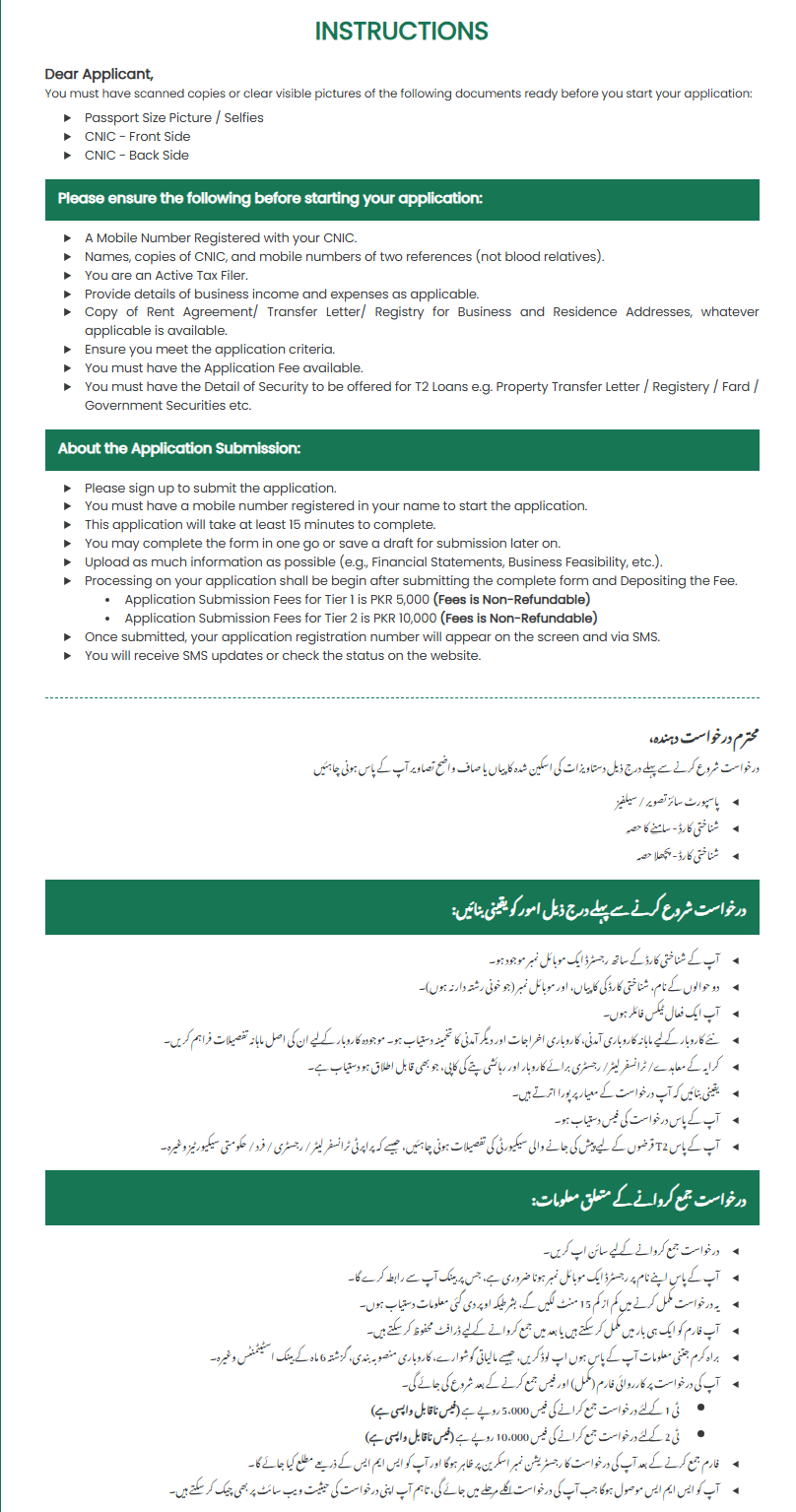

Before beginning your application, make sure the following scanned documents are ready and clear:

- Passport-size photo or a recent selfie.

- CNIC (Front and Back copies).

- Mobile number registered with your CNIC.

- Details of two references (non-blood relatives).

- Tax filer proof (active tax filer status is mandatory).

- If applicable:

- Business registration documents.

- Rental agreement or proof of ownership for your business location.

- Financial statements.

8070 Registration Online 2025 – Get Rs. 10,000 Under CM Punjab Ramzan Rashan Program

CM Punjab Ramzan Rashan Program The Punjab direction, under the control of Chief Minister Maryam Nawaz Sharif, has launched the 8070CM Punjab Ramzan …

Business Loan Scheme 2025 The Punjab government, under the leadership of Chief Minister Maryam Nawaz Sharif, has introduced the Maryam Nawaz Business …

Khyber Pakhtunkhwa launches housing scheme – How to apply?

housing scheme To enable to offer its direction employees with affordable housing options, the local government of Khyber Pakhtunkhwa (KP) is launching …

9999 PM Rashan Application Rejection: Reasons and Solutions

PM Rashan Application Rejection The 9999 PM Rashan Application Rejection Program is a direction initiative aimed at if financial help to low-income …

Step-by-Step Application Process

Step 1: Visit the Official Website

Navigate to the official website of the scheme. (https://akf.punjab.gov.pk/landing) On the homepage, click on the “About Programs” button to view detailed instructions.

Step 2: Read and Follow the Instructions

Ensure all instructions are thoroughly read to avoid mistakes during registration. Pay attention to the following points:

- Use your own information for all required fields.

- Double-check all details, as errors cannot be corrected after submission.

- Avoid blurry or incomplete uploads of documents.

Step 3: Create Your Account

Click on the “Register Now” button to begin. Fill in the required fields, including:

- Full Name (as per CNIC).

- Father’s or Husband’s Name (for married women).

- CNIC Number.

- Active email address and mobile number registered under your CNIC.

- Date of Birth, CNIC issuance, and expiry dates.

Step 4: Fill Personal Information

Enter your current address, district, and tehsil. Provide information about whether you are disabled or have any existing loans.

Step 5: Business Details

Add details about your business, including:

- Business Name.

- Contact information and email address.

- Type of business (manufacturing, services, etc.).

- Monthly revenue, expenses, and number of employees.

- Business ownership status (rented or owned).

- Tax Registration Number (if applicable).

Step 6: Loan Details

Specify the purpose of the loan (e.g., business expansion, working capital). Choose your loan tier and mention the required loan amount. State the repayment period (in years).

Step 7: References

Provide details of two non-blood relatives who can vouch for you, including:

- Full Names.

- Mobile Numbers.

- CNIC Numbers.

Step 8: Upload Documents

Upload the required documents in their respective fields. Ensure they meet the following criteria:

- Documents are clear and legible.

- Files are compressed to an acceptable size without losing quality.

Step 9: Submit Your Application

Review all the details you’ve entered. Click on the Submit button to complete the application. Upon submission, you will receive a registration number and SMS confirmation.

Important Tips for a Successful Application

- Double-check your details: Errors in your information might lead to disqualification.

- Follow the deadlines: Ensure your application is submitted well before the deadline.

- Save your progress: Use the “Save Draft” option to avoid losing data during the process.

Stay informed: Regularly check the status of your application via the official website.

What Happens After Submission?

After your application is submitted, it will undergo a review process. Successful applicants will receive SMS updates regarding their loan approval.

Frequently Asked Questions

Who can apply for this scheme?

Only residents of Punjab with a valid domicile and active tax filer status can apply.

2. How long does the application process take?

The application form typically takes 15 minutes to complete, provided all your documents are ready.

3. Is there any fee for applying?

The application is free of charge. However, for Tier 2 loans, a deposit may be required.

Conclusion

The Asaan Karobar Finance Scheme is a remarkable step by the Punjab government to support small and medium-sized businesses. By following the outlined steps and preparing the required documents, you can ensure a hassle-free application process. For further assistance, refer to the official video or contact the support team. Stay tuned for updates, and good luck with your application!